Question: show calculations A Moving to another question will save this response Question 1 Lulu Hypermarket has a pickup truck that it uses to deliver the

show calculations

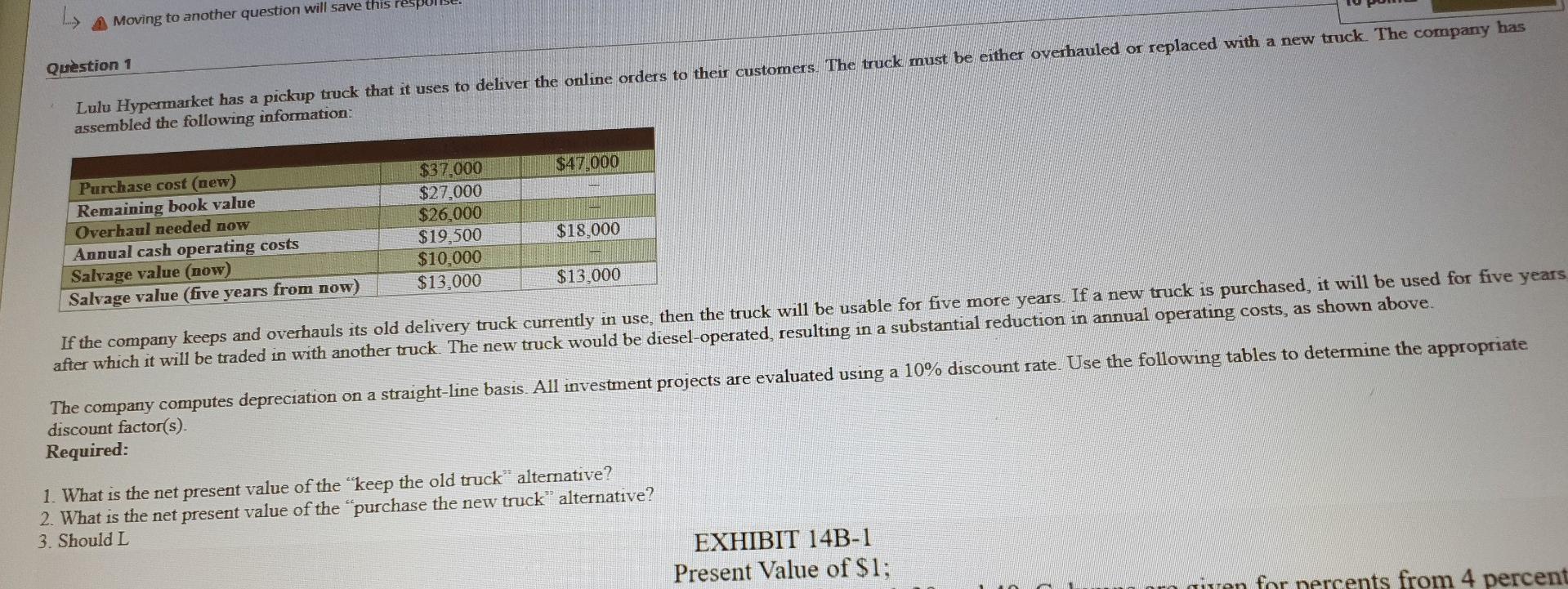

A Moving to another question will save this response Question 1 Lulu Hypermarket has a pickup truck that it uses to deliver the online orders to their customers. The truck must be either overhauled or replaced with a new truck. The company has assembled the following information: $47,000 $37,000 $27,000 $26.000 $19,500 $10,000 $13,000 Purchase cost (new) Remaining book value Overhaul needed now Annual cash operating costs Salvage value (now) Salvage value (five years from now) $18,000 $13,000 If the company keeps and overhauls its old delivery truck currently in use, then the truck will be usable for five more years. If a new truck is purchased, it will be used for five years after which it will be traded in with another truck The new truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 10% discount rate. Use the following tables to determine the appropriate discount factor(s). Required: 1. What is the net present value of the "keep the old truck" alternative? 2. What is the net present value of the purchase the new truck" alternative? 3. Should I EXHIBIT 14B-1 Present Value of $1; quen for persents from 4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts