Question: need the answer for question 2 only, very fast, please help me! 2 Lulu Hypermarket has a pickup truck that it uses to deliver

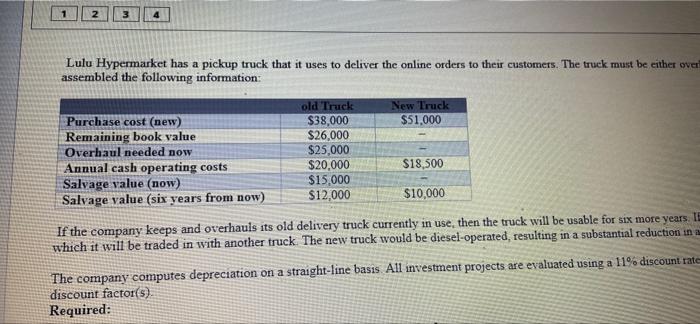

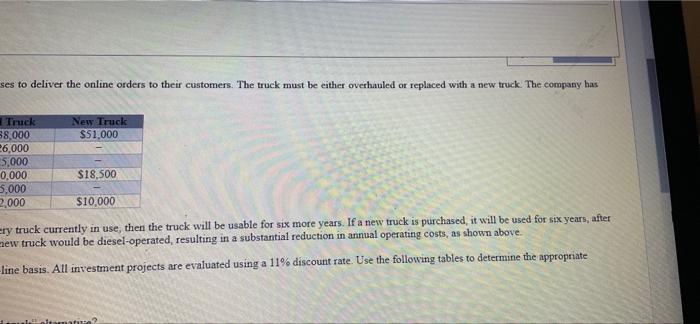

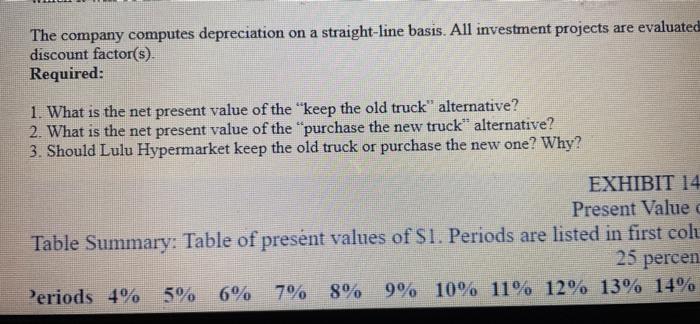

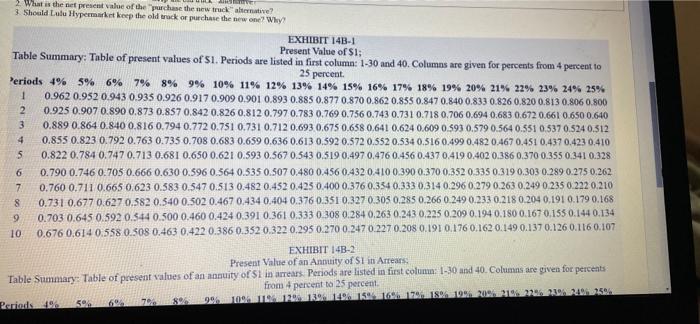

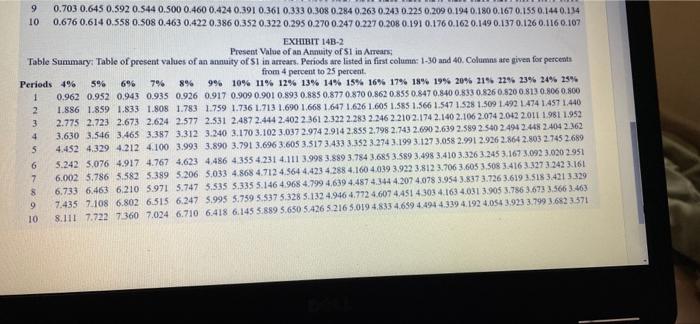

2 Lulu Hypermarket has a pickup truck that it uses to deliver the online orders to their customers. The truck must be either over assembled the following information: old Truck New Truck Purchase cost (new) $38,000 $51.000 Remaining book value $26,000 Overhaul needed now $25,000 Annual cash operating costs $20,000 $18,500 Salvage value (now) $15.000 Salvage value (six years from now) $12,000 $10,000 If the company keeps and overhauls its old delivery truck currently in use, then the truck will be usable for six more years which it will be traded in with another truck. The new truck would be diesel-operated, resulting in a substantial reduction in a The company computes depreciation on a straight-line basis All investment projects are evaluated using a 11% discount rate discount factor(s). Required: TE ses to deliver the online orders to their customers. The truck must be either overhauled or replaced with a new truck. The company has New Truck $$1,000 Truck 38,000 6,000 5,000 0.000 5,000 2.000 $18,500 $10,000 ery truck currently in use, then the truck will be usable for six more years. If a new truck is purchased, it will be used for six years, after mew truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. -line basis. All investment projects are evaluated using a 11% discount rate. Use the following tables to determine the appropriate The company computes depreciation on a straight-line basis. All investment projects are evaluated discount factor(s). Required: 1. What is the net present value of the "keep the old truck" alternative? 2. What is the net present value of the "purchase the new truck" alternative? 3. Should Lulu Hypermarket keep the old truck or purchase the new one? Why? EXHIBIT 14 Present Value Table Summary: Table of presnt values of $1. Periods are listed in first colu 25 percen Periods 4% 5% % % 6% 7% 8% 9% 10% 11% 12% 13% 14% 2. What is the nel present value of the purchase the new truck alternative? 3 Should Lulu Hypermarketkeep the old track or purchase the new one? Why EXHIBIT 14B-1 Table Summary: Table of present values of $1. Periods are listed in first column: 1-30 and 40. Columns are given for percents from 4 percent to Present Value of SI; Periods 496 25 percent 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.8470.840 0.833 0.826 0.820 0.813 0.806 0.800 2 0.925 0.907 0.890 0.873 0.8570.842 0.826 0,812 0.797 0.783 0.769 0.736 0.743 0.731 0.7180.706 0.694 0.683 0.672 0.661 0.650 0.640 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.6930.675 0.65806410.624 0,609 0.5930.579 0.564 0.551 0.537 0.524 0.312 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.5160.4990.482 0.467 0.451 0,4370.4230.410 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 6 0.790 0.746 0.705 0.666 0.630 0.596 0.364 0.535 0.5070.480 0.456 0.4320-410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 7 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.4230.400 0.376 0354 0.333 0.314 0.296 0.279 0.263 0.249 0 235 0.222 0.210 8 0.731 0.677 0.6270.582 0.540 0.502 0.467 0.434 04040.376 0.351 0.3270303 0.285 0.266 0.249 0233 0.218 0.2040,1910.179 0.168 9 0.703 0.645 0.592 0.344 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.1940.180 0.167 0.155 0.144 0.134 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.2470 227 0.208 0.1910.176 0.162 0.149 0.1370.126 0.116 0.107 EXHIBIT 14B-2 Present Value of an Annuity of Si in Arrears, Table Summary: Table of present values of an annuity of Si in arrears. Periods are listed in first columu: 1-30 and 40. Columns are given for percents from 4 percent to 25 percent 6 996 Rashads 19 109120315916 17 18 1996 1975 5% 79 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.22 0.209 0.1940.180 0.167 0.15 0.144 0.134 10 0.676 0,614 0.558 0.508 0.463 0.4220.386 0.352 0.322 0.295 0.270 0.2470.227 0.208 0.19 0.1760.162 0.149 0.1370.126 0.116 0.107 EXHIBIT 14B-2 Table Summary: Table of present values of an annuity of Si in arrears. Periods are listed in first column: 1-30 and 40. Columns are given for percenta Present Value of an Annuity of S1 in Arrears from 4 percent to 25 percent Periods 4% 596 696 79% 896 996 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0917 0.909 0.901 0.893 0.885 0.8770.870 0.862 0.855 0.847 0.840 0.833 0.826 0.8200.813 0.806 0.800 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1,626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 3 2.775 2.723 2.673 2.624 2.577 2.531 2487 2.444 2.402 2361 2.322 2.283 2.246 22102.174 2.140 2.106 2.074 2.042 2.011 1.981 1952 4 3,630 3.546 3.465 3387 3.312 3.340 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.389 2.540 2.494 2.44% 2.404 2362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.3173.433 3.352 3.2743.1993.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 6 5.242 5.076 4.917 4.767 4.623 4.486 4355 4.231 4.111 3.998 3.889 3.784 3.6853.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2951 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4712 4,564 4.423 4288 4.160 40393.922 3.812 3.706 3.605 3.508 3.416 3.327 32423.161 8 6.733 6,463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.6394.487 4.344 4.207 4.078 3.9543.8373.726 3.619 2.5183.421 3329 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5 5375,328 5.132 49464.772 4.607 4.451 4 303 4.163 4031 3.905 3.736 3.673 3.566 3.463 10 8.111 7.722 7360 7.024 6.710 6.418 6.145 5.889 5.650 54265 216 5.0994.833 4.659 4.494 4,339 4,192 4.0543923 3.799 3.6833371 2 Lulu Hypermarket has a pickup truck that it uses to deliver the online orders to their customers. The truck must be either over assembled the following information: old Truck New Truck Purchase cost (new) $38,000 $51.000 Remaining book value $26,000 Overhaul needed now $25,000 Annual cash operating costs $20,000 $18,500 Salvage value (now) $15.000 Salvage value (six years from now) $12,000 $10,000 If the company keeps and overhauls its old delivery truck currently in use, then the truck will be usable for six more years which it will be traded in with another truck. The new truck would be diesel-operated, resulting in a substantial reduction in a The company computes depreciation on a straight-line basis All investment projects are evaluated using a 11% discount rate discount factor(s). Required: TE ses to deliver the online orders to their customers. The truck must be either overhauled or replaced with a new truck. The company has New Truck $$1,000 Truck 38,000 6,000 5,000 0.000 5,000 2.000 $18,500 $10,000 ery truck currently in use, then the truck will be usable for six more years. If a new truck is purchased, it will be used for six years, after mew truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. -line basis. All investment projects are evaluated using a 11% discount rate. Use the following tables to determine the appropriate The company computes depreciation on a straight-line basis. All investment projects are evaluated discount factor(s). Required: 1. What is the net present value of the "keep the old truck" alternative? 2. What is the net present value of the "purchase the new truck" alternative? 3. Should Lulu Hypermarket keep the old truck or purchase the new one? Why? EXHIBIT 14 Present Value Table Summary: Table of presnt values of $1. Periods are listed in first colu 25 percen Periods 4% 5% % % 6% 7% 8% 9% 10% 11% 12% 13% 14% 2. What is the nel present value of the purchase the new truck alternative? 3 Should Lulu Hypermarketkeep the old track or purchase the new one? Why EXHIBIT 14B-1 Table Summary: Table of present values of $1. Periods are listed in first column: 1-30 and 40. Columns are given for percents from 4 percent to Present Value of SI; Periods 496 25 percent 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.8470.840 0.833 0.826 0.820 0.813 0.806 0.800 2 0.925 0.907 0.890 0.873 0.8570.842 0.826 0,812 0.797 0.783 0.769 0.736 0.743 0.731 0.7180.706 0.694 0.683 0.672 0.661 0.650 0.640 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.6930.675 0.65806410.624 0,609 0.5930.579 0.564 0.551 0.537 0.524 0.312 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.5160.4990.482 0.467 0.451 0,4370.4230.410 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 6 0.790 0.746 0.705 0.666 0.630 0.596 0.364 0.535 0.5070.480 0.456 0.4320-410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 7 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.4230.400 0.376 0354 0.333 0.314 0.296 0.279 0.263 0.249 0 235 0.222 0.210 8 0.731 0.677 0.6270.582 0.540 0.502 0.467 0.434 04040.376 0.351 0.3270303 0.285 0.266 0.249 0233 0.218 0.2040,1910.179 0.168 9 0.703 0.645 0.592 0.344 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.1940.180 0.167 0.155 0.144 0.134 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.2470 227 0.208 0.1910.176 0.162 0.149 0.1370.126 0.116 0.107 EXHIBIT 14B-2 Present Value of an Annuity of Si in Arrears, Table Summary: Table of present values of an annuity of Si in arrears. Periods are listed in first columu: 1-30 and 40. Columns are given for percents from 4 percent to 25 percent 6 996 Rashads 19 109120315916 17 18 1996 1975 5% 79 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.22 0.209 0.1940.180 0.167 0.15 0.144 0.134 10 0.676 0,614 0.558 0.508 0.463 0.4220.386 0.352 0.322 0.295 0.270 0.2470.227 0.208 0.19 0.1760.162 0.149 0.1370.126 0.116 0.107 EXHIBIT 14B-2 Table Summary: Table of present values of an annuity of Si in arrears. Periods are listed in first column: 1-30 and 40. Columns are given for percenta Present Value of an Annuity of S1 in Arrears from 4 percent to 25 percent Periods 4% 596 696 79% 896 996 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0917 0.909 0.901 0.893 0.885 0.8770.870 0.862 0.855 0.847 0.840 0.833 0.826 0.8200.813 0.806 0.800 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1,626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 3 2.775 2.723 2.673 2.624 2.577 2.531 2487 2.444 2.402 2361 2.322 2.283 2.246 22102.174 2.140 2.106 2.074 2.042 2.011 1.981 1952 4 3,630 3.546 3.465 3387 3.312 3.340 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.389 2.540 2.494 2.44% 2.404 2362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.3173.433 3.352 3.2743.1993.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 6 5.242 5.076 4.917 4.767 4.623 4.486 4355 4.231 4.111 3.998 3.889 3.784 3.6853.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2951 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4712 4,564 4.423 4288 4.160 40393.922 3.812 3.706 3.605 3.508 3.416 3.327 32423.161 8 6.733 6,463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.6394.487 4.344 4.207 4.078 3.9543.8373.726 3.619 2.5183.421 3329 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5 5375,328 5.132 49464.772 4.607 4.451 4 303 4.163 4031 3.905 3.736 3.673 3.566 3.463 10 8.111 7.722 7360 7.024 6.710 6.418 6.145 5.889 5.650 54265 216 5.0994.833 4.659 4.494 4,339 4,192 4.0543923 3.799 3.6833371

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts