Question: Show full working to each questions answer MULTIPLE CHOICE The following information relates to Questions 11-15 It is March and you grow sugarcane on your

Show full working to each questions answer

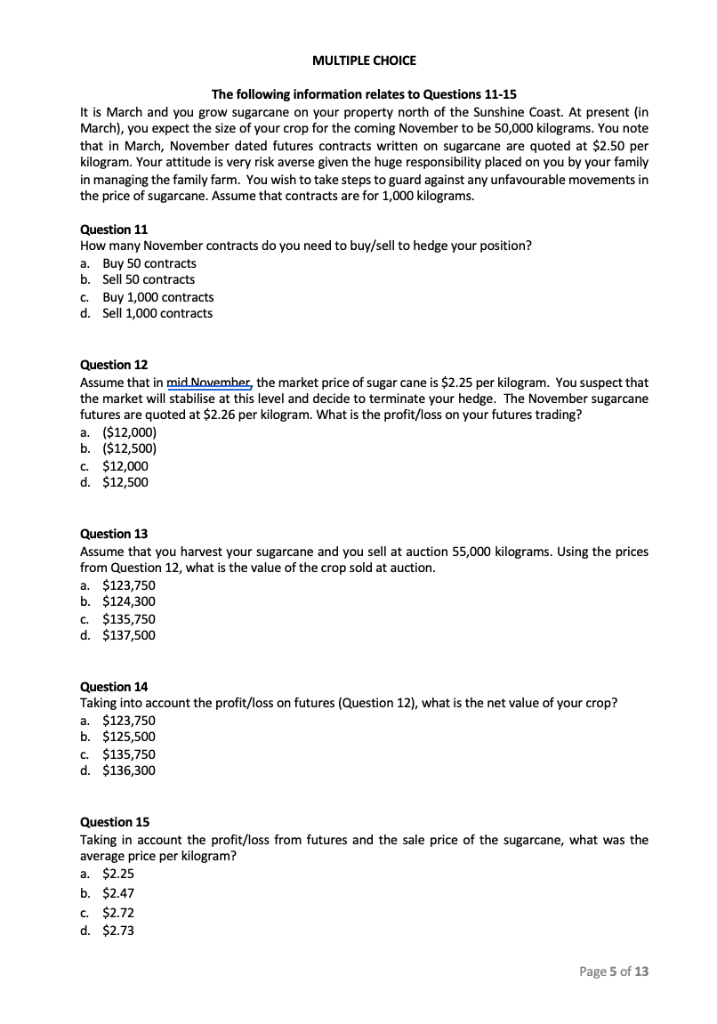

MULTIPLE CHOICE The following information relates to Questions 11-15 It is March and you grow sugarcane on your property north of the Sunshine Coast. At present (in March), you expect the size of your crop for the coming November to be 50,000 kilograms. You note that in March, November dated futures contracts written on sugarcane are quoted at $2.50 per kilogram. Your attitude is very risk averse given the huge responsibility placed on you by your family in managing the family farm. You wish to take steps to guard against any unfavourable movements in the price of sugarcane. Assume that contracts are for 1,000 kilograms. Question 11 How many November contracts do you need to buy/sell to hedge your position? a. Buy 50 contracts b. Sell 50 contracts c. Buy 1,000 contracts d. Sell 1,000 contracts Question 12 Assume that in mid Novwemher, the market price of sugar cane is $2.25 per kilogram. You suspect that the market will stabilise at this level and decide to terminate your hedge. The November sugarcane futures are quoted at $2.26 per kilogram. What is the profit/loss on your futures trading? a. ($12,000) b. ($12,500) c. $12,000 d. $12,500 Question 13 Assume that you harvest your sugarcane and you sell at auction 55,000 kilograms. Using the prices from Question 12, what is the value of the crop sold at auction. a. $123,750 b. $124,300 c. $135,750 d. $137,500 Question 14 Taking into account the profit/loss on futures (Question 12), what is the net value of your crop? a. $123,750 b. $125,500 c. $135,750 d. $136,300 Question 15 Taking in account the profit/loss from futures and the sale price of the sugarcane, what was the average price per kilogram? a. $2.25 b. $2.47 c. $2.72 d. $2.73 Page 5 of 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts