Question: Show how to do on a financial calculator please... Drongo Corporation's 4-year bonds currently yield 7.7 percent and have an inflation premium of 3.7%. The

Show how to do on a financial calculator please...

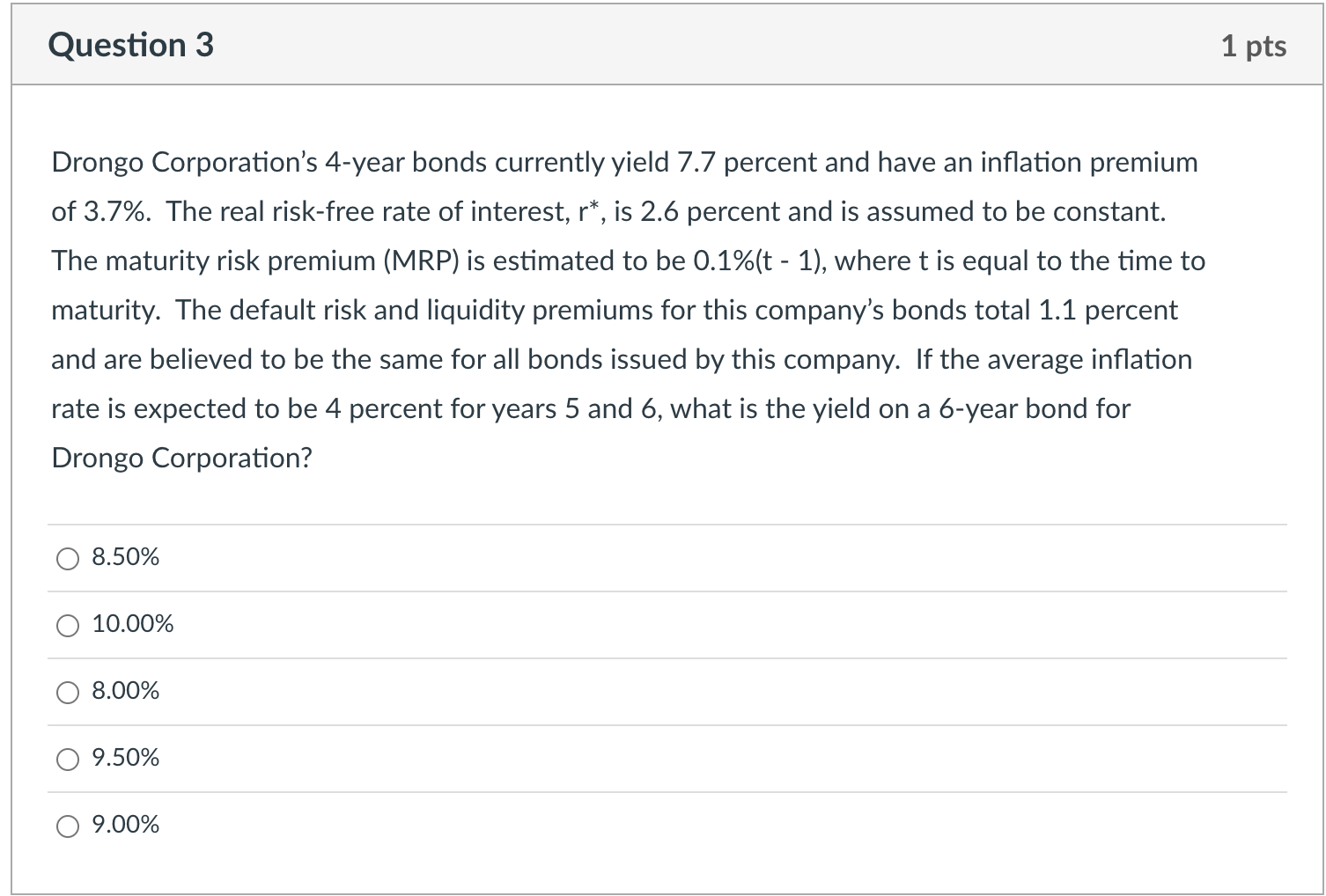

Drongo Corporation's 4-year bonds currently yield 7.7 percent and have an inflation premium of 3.7%. The real risk-free rate of interest, r, is 2.6 percent and is assumed to be constant. The maturity risk premium (MRP) is estimated to be 0.1%(t1), where t is equal to the time to maturity. The default risk and liquidity premiums for this company's bonds total 1.1 percent and are believed to be the same for all bonds issued by this company. If the average inflation rate is expected to be 4 percent for years 5 and 6 , what is the yield on a 6-year bond for Drongo Corporation? \begin{tabular}{c} 8.50% \\ \hline 10.00% \\ \hline 8.00% \\ \hline 9.50% \\ \hline 9.00% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts