Question: show how to solve using excell formulas 12. An office building property can be purchased for $5.0 milition. It is expected to generate annual NOIs

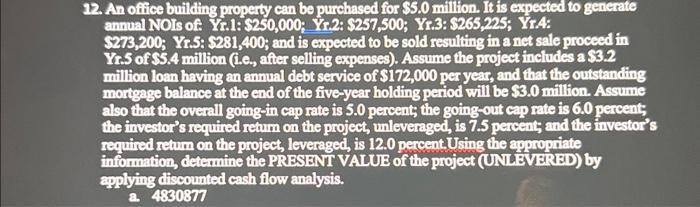

12. An office building property can be purchased for $5.0 milition. It is expected to generate annual NOIs of Yr.1: $250,000; Yr.2: $257,500; Yr 3: 5265,225 ; Yr.4: $273,200; Yr.5: $281,400; and is expected to be sold resulting in a net sale proceed in YrS of 55.4 million (i.e., after selling expenses). Assume the project includes a 33.2 million loan having an annual debt service of $172,000 per year, and that the outstanding mortgage balance at the end of the five-year holding period will be $3.0 million. Assume also that the overall going in cap rate is 5.0 percent; the going-out cap rate is 6.0 percent; the investor's required retum on the project, unleveraged, is 7.5 percent; and the investor's required retum on the project, leveraged, is 12.0 percent Using the appropriate information, determine the PRESENI VALUE of the project (UNIE VVERED) by applying discounted cash flow analysis. a. 4830877

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts