Question: show how to solve using excell formulas 14. An office building property can be purchased for $5.0 million. It is expected to generate annual NOIs

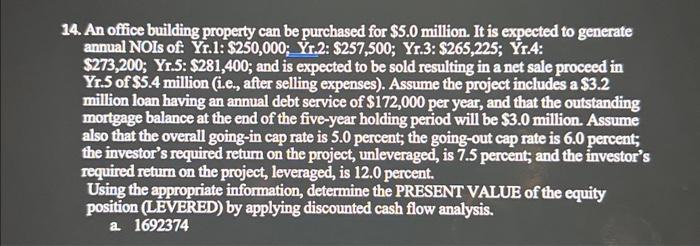

14. An office building property can be purchased for $5.0 million. It is expected to generate annual NOIs of: Yr.1: $250,000; Yr. 2: $257,500; Yr.3: $265,225; Yr.4: $273,200; Yr.5: $281,400; and is expected to be sold resulting in a net sale proceed in Yr.5 of $5.4 milition (i.e., after selling expenses). Assume the project includes a $3.2 million loan having an annual debt service of $172,000 per year, and that the outstanding mortgage balance at the end of the five-year holding period will be $3.0 million. Assume also that the overall going-in cap rate is 5.0 percent; the going-out cap rate is 6.0 percent; the investor's required returm on the project, unleveraged, is 7.5 percent; and the investor's required retum on the project, leveraged, is 12.0 percent. Using the appropriate information, determine the PRBSENT VALUE of the equity position (LEVERED) by applying discounted cash flow analysis. a. 1692374

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts