Question: Show how you got the answer. 1. A, B & C agree to the formation of a general partnership (ABC) in which each will have

Show how you got the answer.

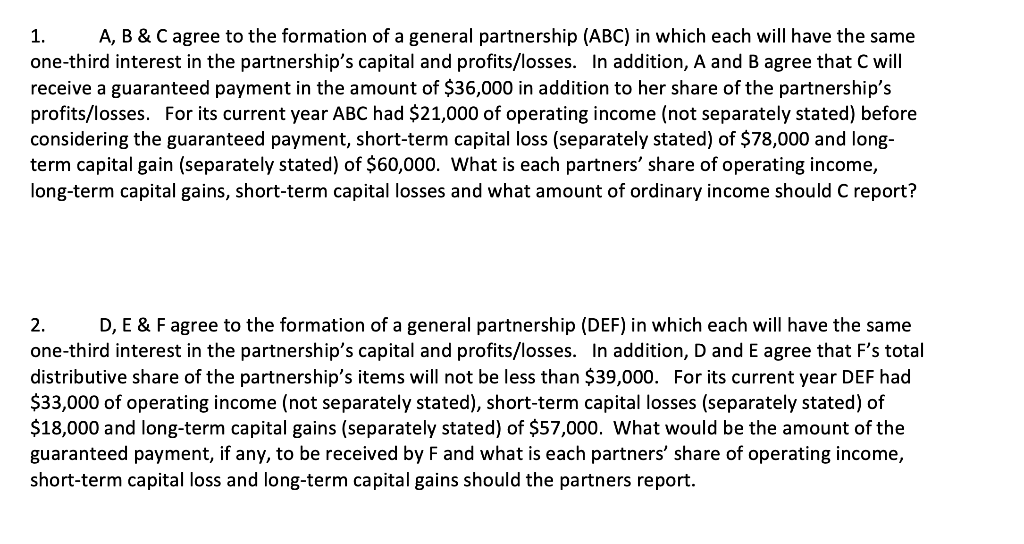

1. A, B \& C agree to the formation of a general partnership (ABC) in which each will have the same one-third interest in the partnership's capital and profits/losses. In addition, A and B agree that C will receive a guaranteed payment in the amount of $36,000 in addition to her share of the partnership's profits/losses. For its current year ABC had $21,000 of operating income (not separately stated) before considering the guaranteed payment, short-term capital loss (separately stated) of $78,000 and longterm capital gain (separately stated) of $60,000. What is each partners' share of operating income, long-term capital gains, short-term capital losses and what amount of ordinary income should C report? 2. D, E \& F agree to the formation of a general partnership (DEF) in which each will have the same one-third interest in the partnership's capital and profits/losses. In addition, D and E agree that F's total distributive share of the partnership's items will not be less than $39,000. For its current year DEF had $33,000 of operating income (not separately stated), short-term capital losses (separately stated) of $18,000 and long-term capital gains (separately stated) of $57,000. What would be the amount of the guaranteed payment, if any, to be received by F and what is each partners' share of operating income, short-term capital loss and long-term capital gains should the partners report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts