Question: show how you got the answer A B F 0 0 0 0 800 Compute ROA, ROE and ROFL and Interpret the Effects of Leverage

show how you got the answer

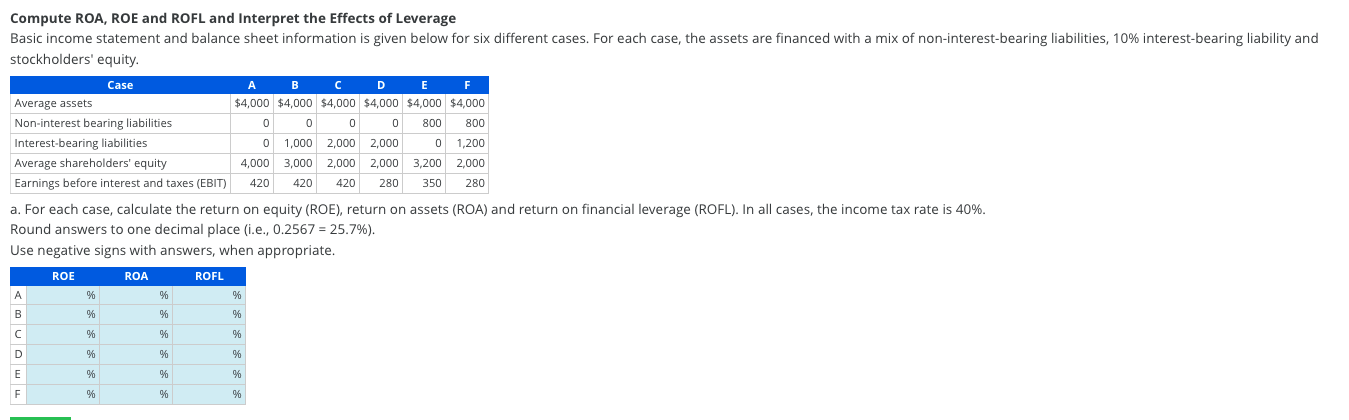

A B F 0 0 0 0 800 Compute ROA, ROE and ROFL and Interpret the Effects of Leverage Basic income statement and balance sheet information is given below for six different cases. For each case, the assets are financed with a mix of non-interest-bearing liabilities, 10% interest-bearing liability and stockholders' equity. Case B D E Average assets $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 Non-interest bearing liabilities 800 Interest-bearing liabilities 1,000 2,000 2.000 0 1,200 Average shareholders' equity 4,000 3,000 2,000 2,000 3,200 2,000 Earnings before interest and taxes (EBIT) 420 280 350 280 a. For each case, calculate the return on equity (ROE), return on assets (ROA) and return on financial leverage (ROFL). In all cases, the income tax rate is 40%. Round answers to one decimal place (i.e., 0.2567 = 25.7%). Use negative signs with answers, when appropriate. ROE ROA ROFL 0 420 420 A % % % B % % % % % % % 9 D % % % E % % % F F % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts