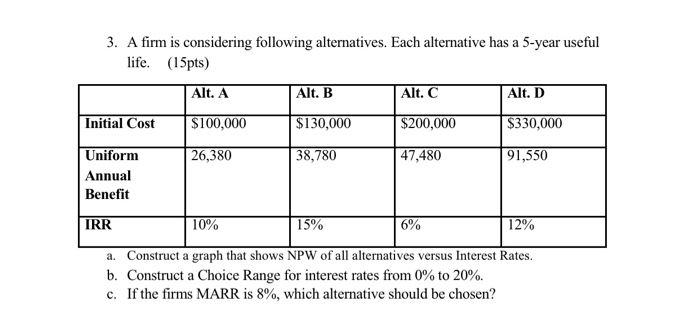

Question: show how you got the answer using excel 3. A firm is considering following alternatives. Each alternative has a 5-year useful life. (15pts) Alt. D

3. A firm is considering following alternatives. Each alternative has a 5-year useful life. (15pts) Alt. D Initial Cost Alt. A $100,000 26,380 Alt. B $130,000 38,780 Alt. C $200,000 47,480 $330,000 91,550 Uniform Annual Benefit IRR 10% 15% 12% a. Construct a graph that shows NPW of all alternatives versus Interest Rates. b. Construct a Choice Range for interest rates from 0% to 20%. c. If the firms MARR is 8%, which alternative should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts