Question: Show me how to prepare a general journal entry given instructions and chart of accounts ASSETS 100 Cash-Checking 105 Cash-Savings 110 Accounts Receivable-Mr. Abrams 111

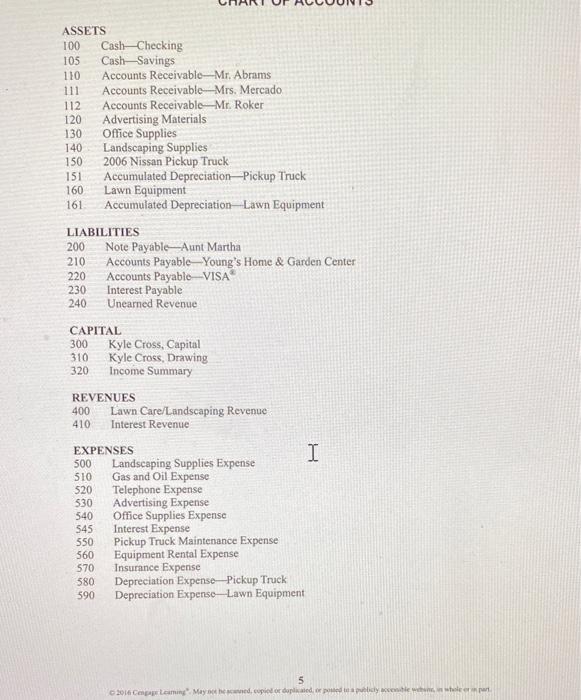

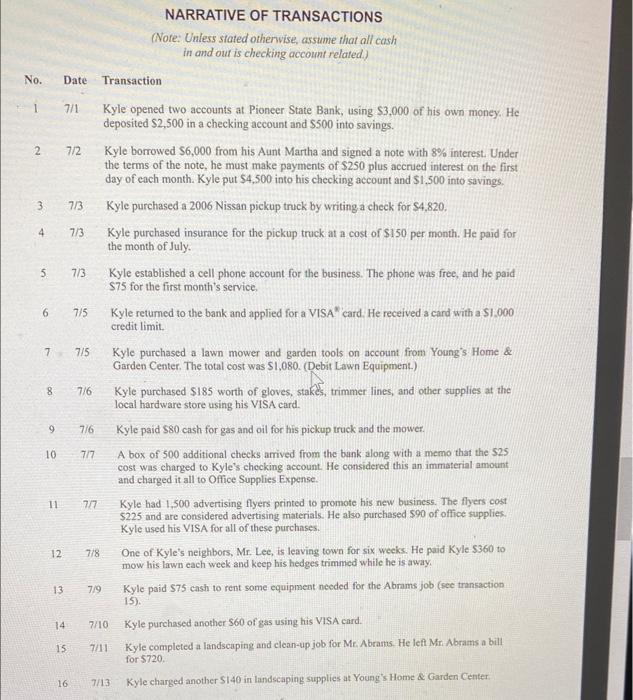

ASSETS 100 Cash-Checking 105 Cash-Savings 110 Accounts Receivable-Mr. Abrams 111 Accounts Receivable-Mrs. Mercado 112 Accounts Receivable-Mr. Roker 120 Advertising Materials 130 Office Supplies 140 Landscaping Supplies 1502006 Nissan Pickup Truck 151 Accumulated Depreciation-Pickup Truck 160 Lawn Equipment 161. Accumulated Depreciation Lawn Equipment LIABILITIES 200 Note Payable-Aunt Martha 210 Accounts Payable -Young's Home \& Garden Center 220 Accounts Payable-VISA 230 Interest Payable 240 Unearned Revenue CAPITAL 300 Kyle Cross, Capital 310 Kyle Cross, Drawing 320 Income Summary REVENUES 400 Lawn Care/Landscaping Revenue 410 Interest Revenue 5 NARRATIVE OF TRANSACTIONS (Nore: Unless siated othenvise, assume that all cash in and out is checking account related.) No. Date Transaction 17i1 Kyle opened two accounts at Pioneer State Bank, using $3,000 of his own money. He deposited $2,500 in a checking account and $500 into savings. 27/2 Kyle borrowed $6,000 from his Aunt Martha and signed a note with 8% interest. Under the terms of the note, he must make payments of $250 plus accrued interest on the first day of each month. Kyle put $4,500 into his checking account and $1,500 into savings. 3. 7/3 Kyle purchased a 2006 Nissan pickup truck by writing a check for $4,820. 47/3 Kyle purchased insurance for the pickup truck at a cost of $150 per month. He paid for the month of July. 5. 7/3 Kyle established a cell phone account for the business. The phone was free, and he paid $75 for the first month's service. 67/5 Kyle retumed to the bank and applied for a VISA card. He received a card with a SI ,000 credit limit. 7 . 7/5 Kyle purchased a lawn mower and garden tools on account from Young's Home \& Garden Center. The total cost was \$1,080. (Debit Lawn Equipment.) 8776 Kyle purchased $185 worth of gloves, stakes, trimmer lines, and other supplies at the local hardware store using his VISA card. 97/6 Kyle paid $80 cash for gas and oil for his pickup truck and the mower. 107/7 A box of 500 additional checks arrived from the bunk along with a memo that the 525 cost was charged to Kyle's checking account. He considered this an immaterial amount. and charged it all to Office Supplies Expense. 117/. Kyle had 1,500 advertising flyers printed to promote his new business. The flyers cost $225 and are considered advertising materials. He also purchased $90 of office supplies: Kyle used his VISA for all of these purchases. 12. 778 One of Kyle's neighbors, Mr. Lee, is leaving town for six weeks. He paid Kyle $360 to mow his lawn each week and keep his hedges trimmed while he is away. 13.7/9 Kyle paid 575 cash to rent some equipment needed for the Abrams job (see transaction 15). 147710 Kyle purchased another $60 of gas using his VISA card. 15 7a1 Kyle completed a landscaping and clean-up job for Mc. Abrams. He left Mr. Abrams a bill for $720. 167713 Kyle charged another SI40 in landscaping supplies at Young's Home \& Garden Center

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts