Question: show me on T account for 2014 , 2015 using Absorption method and Variable cost . show also Gross profit and Net income for both

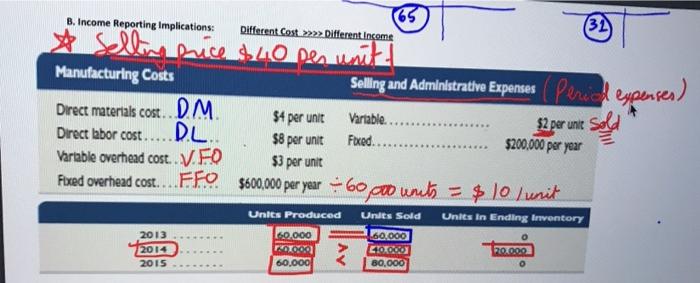

B. Income Reporting Implications: 65 Different Cost >>>> Different. Income (31) Manufacturing Costs Administrative Direct materials cost $4 per unit Vartable..... $2 per une Direct labor cost. $8 per unit Foxed. $200,000 per year Variable overhead cost...V.FO $3 per unit Fixed overhead cost....FFO$600,000 per year - 60,00 units = $ 10 unit Selline hice $40 Den unit DM DL. Units Produced Units Sold Units in Ending Inventory 2013 2014 2015 60.000 OOOO 60.000 L60.000) Co 80,000 120.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts