Question: Show me the steps to solve Question 1 ( 1 5 p ) Consider a corporate bond. The par value is $ 1 0 0

Show me the steps to solve Question p

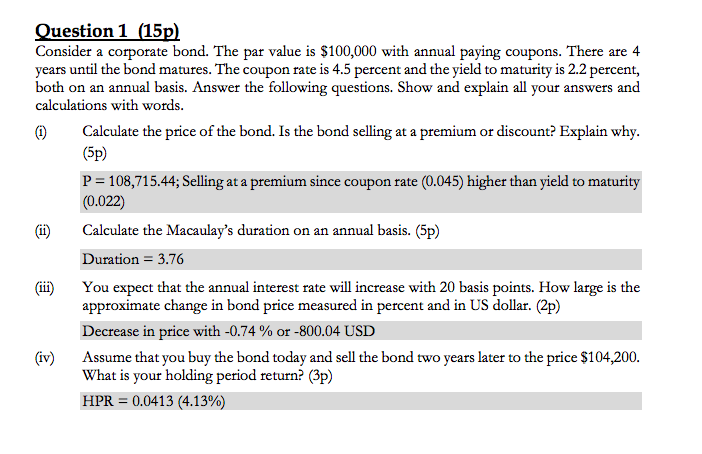

Consider a corporate bond. The par value is $ with annual paying coupons. There are

years until the bond matures. The coupon rate is percent and the yield to maturity is percent,

both on an annual basis. Answer the following questions. Show and explain all your answers and

calculations with words.

i Calculate the price of the bond. Is the bond selling at a premium or discount? Explain why.

; Selling at a premium since coupon rate higher than yield to maturity

ii Calculate the Macaulay's duration on an annual basis. p

Duration

iii You expect that the annual interest rate will increase with basis points. How large is the

approximate change in bond price measured in percent and in US dollar. p

Decrease in price with or USD

iv Assume that you buy the bond today and sell the bond two years later to the price $

What is your holding period return? p

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock