Question: On January 1, 2020, Harrison, Inc., acquired 90 percent of Starr Company in exchange for $1,125,000 fair-value consideration. The total fair value of Starr

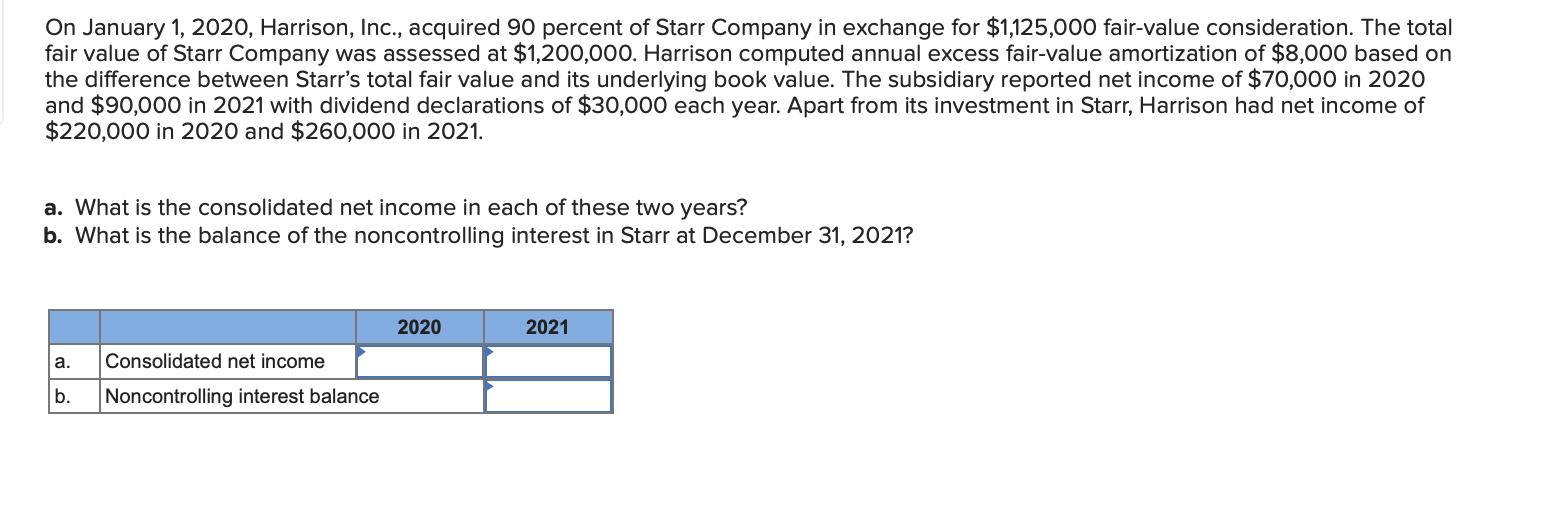

On January 1, 2020, Harrison, Inc., acquired 90 percent of Starr Company in exchange for $1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000. Harrison computed annual excess fair-value amortization of $8,000 based on the difference between Starr's total fair value and its underlying book value. The subsidiary reported net income of $70,000 in 2020 and $90,000 in 2021 with dividend declarations of $30,000 each year. Apart from its investment in Starr, Harrison had net income of $220,000 in 2020 and $260,000 in 2021. a. What is the consolidated net income in each of these two years? b. What is the balance of the noncontrolling interest in Starr at December 31, 2021? 2020 2021 . Consolidated net income b. Noncontrolling interest balance

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts