Question: show steps and explian , the final answer is written down final answer 5. The balance sheet of a company for a previous year is

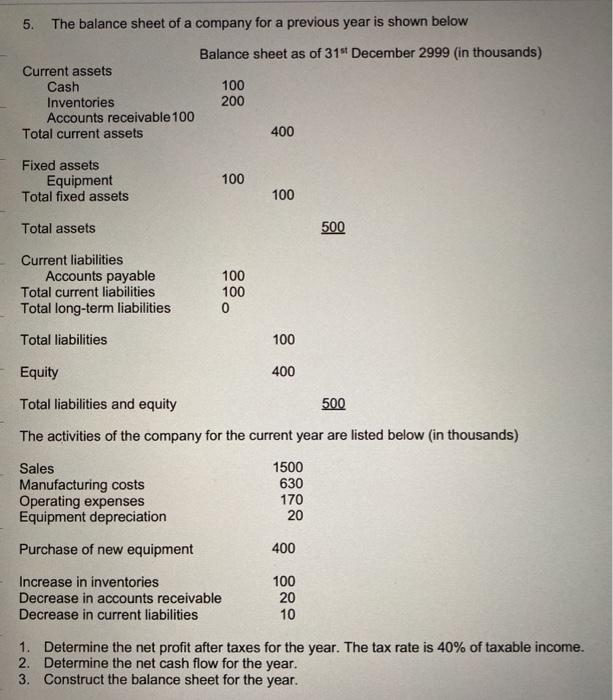

5. The balance sheet of a company for a previous year is shown below Balance sheet as of 31 December 2999 (in thousands) Current assets Cash 100 Inventories Accounts receivable 100 Total current assets 400 200 Fixed assets Equipment Total fixed assets 100 100 Total assets 500 Current liabilities Accounts payable Total current liabilities Total long-term liabilities 100 100 0 Total liabilities 100 Equity 400 Total liabilities and equity 500 The activities of the company for the current year are listed below (in thousands) Sales Manufacturing costs Operating expenses Equipment depreciation 1500 630 170 20 Purchase of new equipment 400 Increase in inventories Decrease in accounts receivable Decrease in current liabilities 100 20 10 1. Determine the net profit after taxes for the year. The tax rate is 40% of taxable income. 2. Determine the net cash flow for the year. 3. Construct the balance sheet for the year. Net profit after taxes $408,000 Net cash flow - $62,000, i.e. negative Balance sheet: Total assets = Total liabilities + equity = $898,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts