Question: show steps and explain , the final answer is written down final answer 4. The Balance Sheet and the Profit and Loss account for a

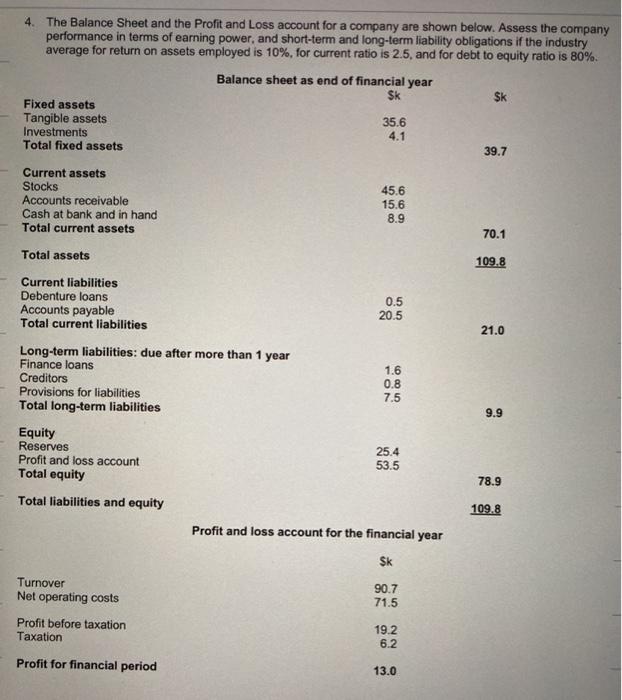

4. The Balance Sheet and the Profit and Loss account for a company are shown below. Assess the company performance in terms of earning power, and short-term and long-term liability obligations if the industry average for return on assets employed is 10%, for current ratio is 2.5, and for debt to equity ratio is 80%. Balance sheet as end of financial year Sk Sk Fixed assets Tangible assets 35.6 Investments 4.1 Total fixed assets 39.7 Current assets Stocks 45.6 Accounts receivable 15.6 Cash at bank and in hand 8.9 Total current assets 70.1 Total assets 109.8 Current liabilities Debenture loans Accounts payable Total current liabilities 0.5 20.5 21.0 Long-term liabilities: due after more than 1 year Finance loans Creditors Provisions for liabilities Total long-term liabilities 1.6 0.8 7.5 9.9 Equity Reserves Profit and loss account Total equity 25.4 53.5 78.9 Total liabilities and equity 109.8 Profit and loss account for the financial year Sk Turnover Net operating costs 90.7 71.5 Profit before taxation Taxation 19.2 6.2 Profit for financial period 13.0 ROAE= 11.8%, better CR= 3.34, better DTER= 39%, better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts