Question: Show steps in excel please B D E F G . I Excel Problem 2 Show All Excel Work (20 points) The Floyd Company has

Show steps in excel please

Show steps in excel please

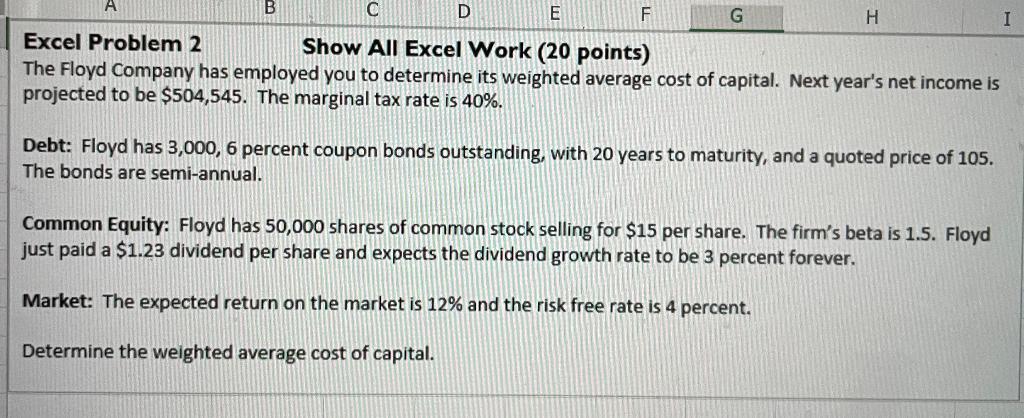

B D E F G . I Excel Problem 2 Show All Excel Work (20 points) The Floyd Company has employed you to determine its weighted average cost of capital. Next year's net income is projected to be $504,545. The marginal tax rate is 40%. Debt: Floyd has 3,000, 6 percent coupon bonds outstanding, with 20 years to maturity, and a quoted price of 105. The bonds are semi-annual. Common Equity: Floyd has 50,000 shares of common stock selling for $15 per share. The firm's beta is 1.5. Floyd just paid a $1.23 dividend per share and expects the dividend growth rate to be 3 percent forever. Market: The expected return on the market is 12% and the risk free rate is 4 percent. Determine the weighted average cost of capital. B D E F G . I Excel Problem 2 Show All Excel Work (20 points) The Floyd Company has employed you to determine its weighted average cost of capital. Next year's net income is projected to be $504,545. The marginal tax rate is 40%. Debt: Floyd has 3,000, 6 percent coupon bonds outstanding, with 20 years to maturity, and a quoted price of 105. The bonds are semi-annual. Common Equity: Floyd has 50,000 shares of common stock selling for $15 per share. The firm's beta is 1.5. Floyd just paid a $1.23 dividend per share and expects the dividend growth rate to be 3 percent forever. Market: The expected return on the market is 12% and the risk free rate is 4 percent. Determine the weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts