Question: Show steps please Question Completion Status: Moving to the next question prevents changes to this answer Question 6 o uestion 6 20 points Save A

Show steps please

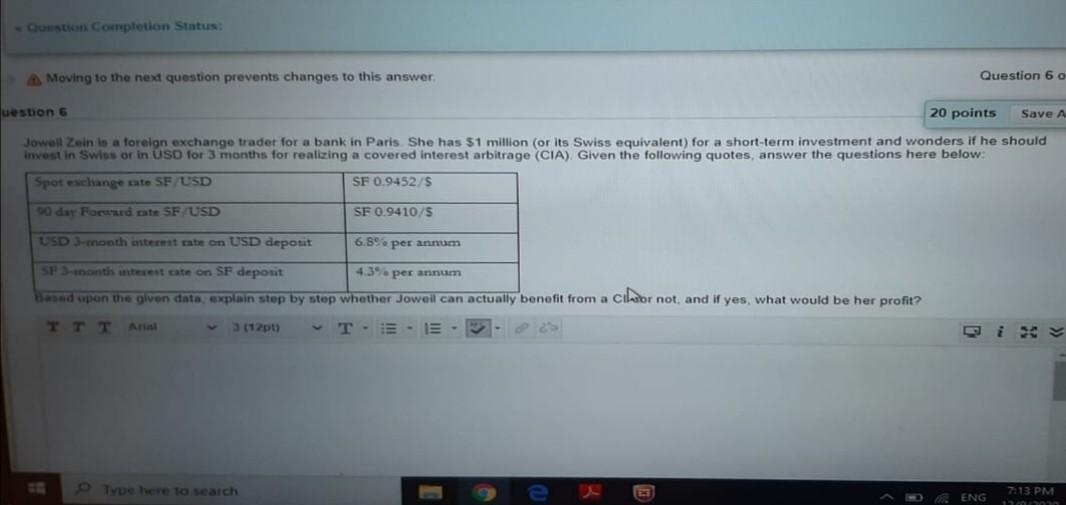

Question Completion Status: Moving to the next question prevents changes to this answer Question 6 o uestion 6 20 points Save A Jowell Zein is a foreign exchange tradet for a bank in Paris. She has $1 million (or its Swiss equivalent) for a short-term investment and wonders if he should Invest in Swiss or in USD for 3 months for realizing a covered interest arbitrage (CIA). Given the following quotes, answer the questions here below: Spot exchange rate SF USD SF 0.9452/5 O day Forrad aute SFUSD SF 0.9410/5 USD 3-month interest rate on USD deposit 6.89 per annum SF onth interest rate on SF deposit 4.3% per annum Based upon the given data, explain step by step whether Jowell can actually benefit from a cilsor not, and if yes, what would be her profit? Anal 3 (120) T-E- E - Type here to search ENG 7:13 PM 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts