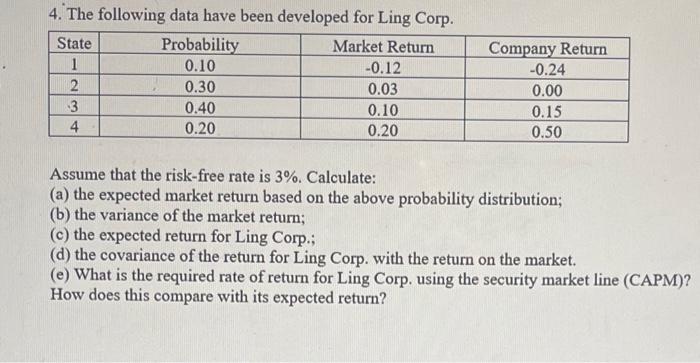

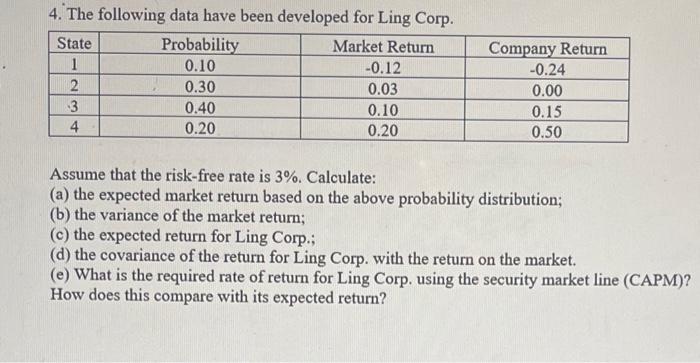

Question: show work 4. The following data have been developed for Ling Corp. State Probability Market Return 1 0.10 -0.12 2 0.30 0.03 3 0.40 0.10

show work

4. The following data have been developed for Ling Corp. State Probability Market Return 1 0.10 -0.12 2 0.30 0.03 3 0.40 0.10 4 0.20 0.20 Company Return -0.24 0.00 0.15 0.50 Assume that the risk-free rate is 3%. Calculate: (a) the expected market return based on the above probability distribution; (b) the variance of the market return; (c) the expected return for Ling Corp.; (d) the covariance of the return for Ling Corp. with the return on the market. (e) What is the required rate of return for Ling Corp, using the security market line (CAPM)? How does this compare with its expected return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock