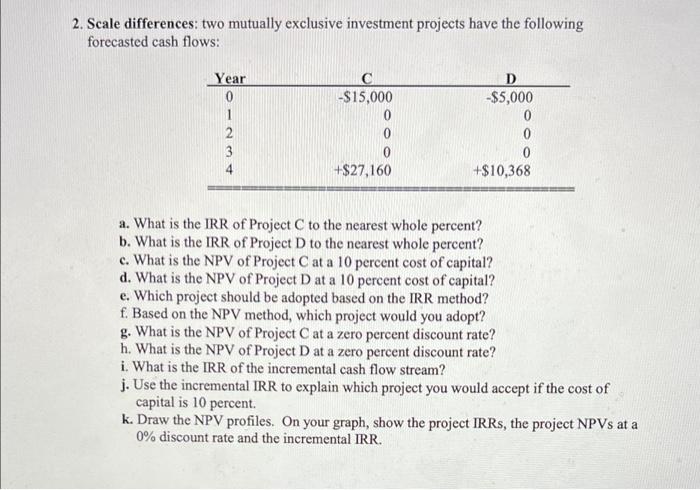

Question: show work please 2. Scale differences: two mutually exclusive investment projects have the following forecasted cash flows: Year 0 1 2 3 4 C -$15,000

2. Scale differences: two mutually exclusive investment projects have the following forecasted cash flows: Year 0 1 2 3 4 C -$15,000 0 0 D -$5,000 0 0 0 +$10,368 +$27,160 a. What is the IRR of Project to the nearest whole percent? b. What is the IRR of Project D to the nearest whole percent? c. What is the NPV of Project Cat a 10 percent cost of capital? d. What is the NPV of Project D at a 10 percent cost of capital? e. Which project should be adopted based on the IRR method? f. Based on the NPV method, which project would you adopt? g. What is the NPV of Project Cat a zero percent discount rate? h. What is the NPV of Project D at a zero percent discount rate? i. What is the IRR of the incremental cash flow stream? j. Use the incremental IRR to explain which project you would accept if the cost of capital is 10 percent k. Draw the NPV profiles. On your graph, show the project IRRs, the project NPVs at a 0% discount rate and the incremental IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts