Question: show work, please do not use financial calculator as basis for proof 8. [10] The Smiths buy a home and take out a $160000 mortgage

show work, please do not use financial calculator as basis for proof

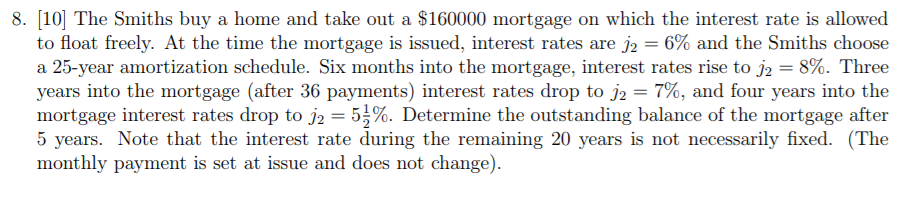

8. [10] The Smiths buy a home and take out a $160000 mortgage on which the interest rate is allowed to float freely. At the time the mortgage is issued, interest rates are j2 = 6% and the Smiths choose a 25-year amortization schedule. Six months into the mortgage, interest rates rise to j2 = 8%. Three years into the mortgage (after 36 payments) interest rates drop to j2 = 7%, and four years into the mortgage interest rates drop to 12 = 51%. Determine the outstanding balance of the mortgage after 5 years. Note that the interest rate during the remaining 20 years is not necessarily fixed. The monthly payment is set at issue and does not change). 8. [10] The Smiths buy a home and take out a $160000 mortgage on which the interest rate is allowed to float freely. At the time the mortgage is issued, interest rates are j2 = 6% and the Smiths choose a 25-year amortization schedule. Six months into the mortgage, interest rates rise to j2 = 8%. Three years into the mortgage (after 36 payments) interest rates drop to j2 = 7%, and four years into the mortgage interest rates drop to 12 = 51%. Determine the outstanding balance of the mortgage after 5 years. Note that the interest rate during the remaining 20 years is not necessarily fixed. The monthly payment is set at issue and does not change)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts