Question: show work please Problem: The historic Ashbrook Hotel is located on 120 acres in the beautiful hills of North Carolina. The hotel's management is looking

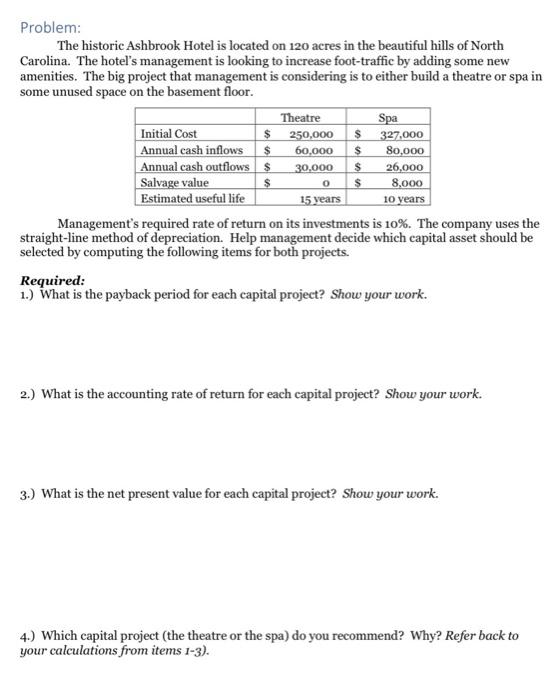

Problem: The historic Ashbrook Hotel is located on 120 acres in the beautiful hills of North Carolina. The hotel's management is looking to increase foot-traffic by adding some new amenities. The big project that management is considering is to either build a theatre or spa in some unused space on the basement floor. Theatre Spa Initial Cost $ 250,000 $ 327,000 60,000 $ 80,000 Annual cash inflows $ Annual cash outflows $ Salvage value 30,000 $ 26,000 $ 0 $ 8,000 Estimated useful life 15 years 10 years Management's required rate of return on its investments is 10%. The company uses the straight-line method of depreciation. Help management decide which capital asset should be selected by computing the following items for both projects. Required: 1.) What is the payback period for each capital project? Show your work. 2.) What is the accounting rate of return for each capital project? Show your work. 3.) What is the net present value for each capital project? Show your work. 4.) Which capital project (the theatre or the spa) do you recommend? Why? Refer back to your calculations from items 1-3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts