Question: show work question Completion Status: Close Window Question 1 of 10 1 A Moing to the next question presents changes to this answer. 10 points

show work

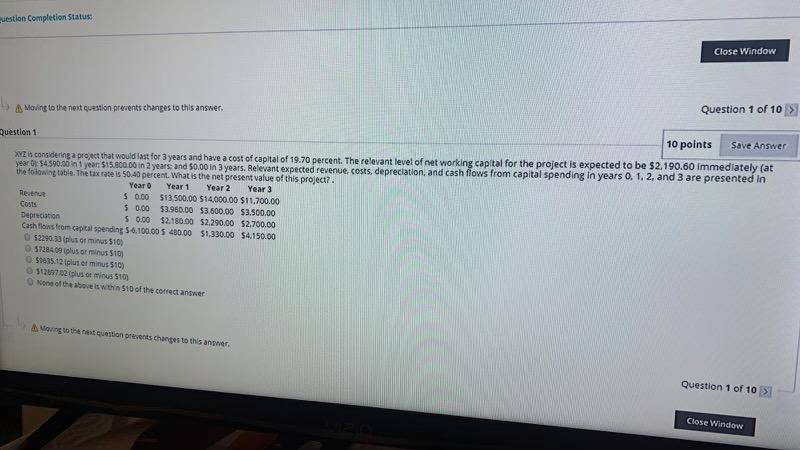

question Completion Status: Close Window Question 1 of 10 1 A Moing to the next question presents changes to this answer. 10 points Save Answer Question 1 XYZ in considering a project that would last for 3 years and have a cost of capital of 19.70 percent. The relevant level of net working capital for the project is expected to be 52.190.60 immediately (at year Ox 54,590.00 1 year $15.000.00 in 2 years and 50.00 in 3 years. Relevant expected revenue, costs, depreciation, and cash flows from capital spending in years 0. 1. 2. and 3 are presented in the folowing table. The tax rate is 50 40 percent. What is the net present value of this project? Year Year 1 Year 2 Year 3 Retur $ 0.00 $13.500.00 $14,000.00 $11.700.00 Costs $ 0.00 53.960.00 $3,600.00 $3,500.00 Depreciation 50.00 $2.180.00 $2,290.00 52.700.00 Cashflows from capital spending 54,100.00 $ 48000 51.330.00 $4.150.00 52290.33 uso minus 510) 5728409 plus ou 510 50535.12 plus minus 510) 12702 lus minus 510) None of the boot is worth $10 of the correct answer Mong to the ton prevents changes to this answer Question 1 of 10 > Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts