Question: show work. thumbs up You work for a large consulting firm. One of your most important clients is in the food processing busines. They are

show work. thumbs up

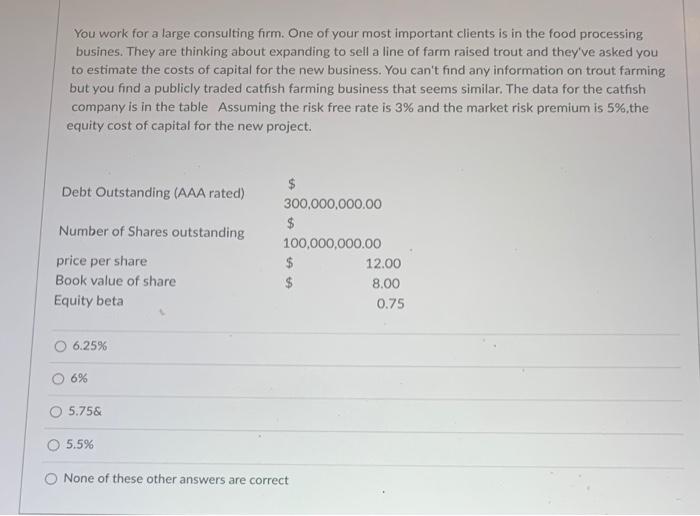

show work. thumbs upYou work for a large consulting firm. One of your most important clients is in the food processing busines. They are thinking about expanding to sell a line of farm raised trout and they've asked you to estimate the costs of capital for the new business. You can't find any information on trout farming but you find a publicly traded catfish farming business that seems similar. The data for the catfish company is in the table Assuming the risk free rate is 3% and the market risk premium is 5%, the equity cost of capital for the new project. Debt Outstanding (AAA rated) Number of Shares outstanding price per share Book value of share Equity beta 300,000,000.00 $ 100,000,000.00 $ 12.00 $ 8.00 0.75 6.25% 6% 5.75& 5.5% None of these other answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts