Question: show work using a calculator 7. Suppose you purchase an annual coupon bond today right after this year's coupon was paid. The coupon rate is

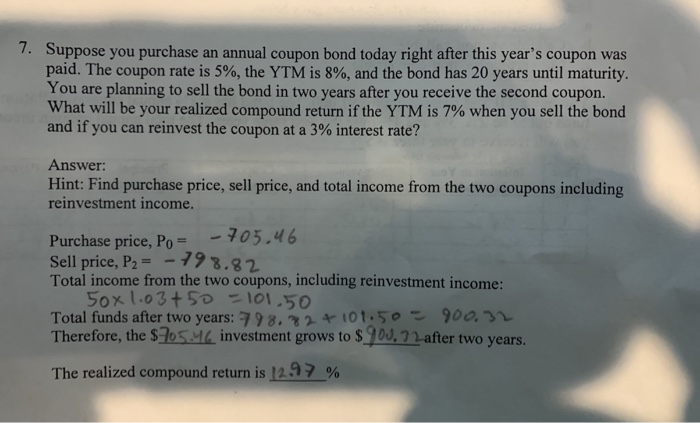

7. Suppose you purchase an annual coupon bond today right after this year's coupon was paid. The coupon rate is 5%, the YTM is 8%, and the bond has 20 years until maturity. You are planning to sell the bond in two years after you receive the second coupon. What will be your realized compound return if the YTM is 7% when you sell the bond and if you can reinvest the coupon at a 3% interest rate? Answer: Hint: Find purchase price, sell price, and total income from the two coupons including reinvestment income. -705.46 - 798.82 Purchase price, Po = Sell price, P2 : Total income from the two coupons, including reinvestment income: 50x 1.03+5o =101,50 Total funds after two years: 79 8.324 101.50 900,32 Therefore, the $705.46 investment grows to $ DJ, I 2-after two years. %3D The realized compound return is 12.97 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts