Question: SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 8: Gaggle Internet, Inc. is evaluating its cost of capital under alternative financing

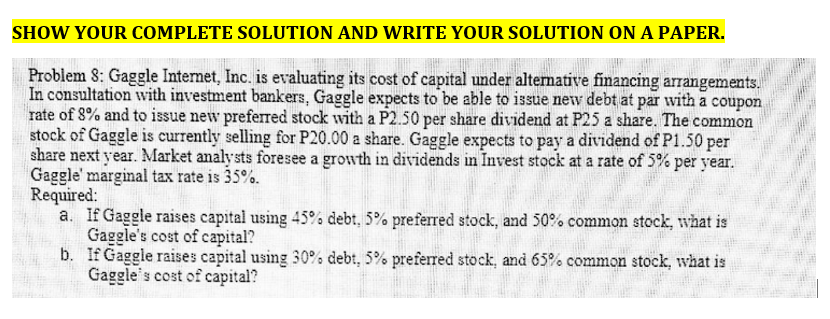

SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 8: Gaggle Internet, Inc. is evaluating its cost of capital under alternative financing arrangements. In consultation with investment bankers, Gaggle expects to be able to issue new debt at par with a coupon rate of 8% and to issue new preferred stock with a P2.50 per share dividend at P25 a share. The common stock of Gaggle is currently selling for P20.00 a share. Gaggle expects to pay a dividend of P1.50 per share next year. Market analysts foresee a growth in dividends in Invest stock at a rate of 5% per year. Gaggle' marginal tax rate is 35%. Required: a. If Gaggle raises capital using 45% debt, 5% preferred stock, and 50% common stock, what is Gaggle's cost of capital? b. If Gaggle raises capital using 30% debt, 5% preferred stock, and 65% common stock, what is Gaggle's cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts