Question: SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 8: Calvin Inc, is considering the purchase of a new state-of-art machine to

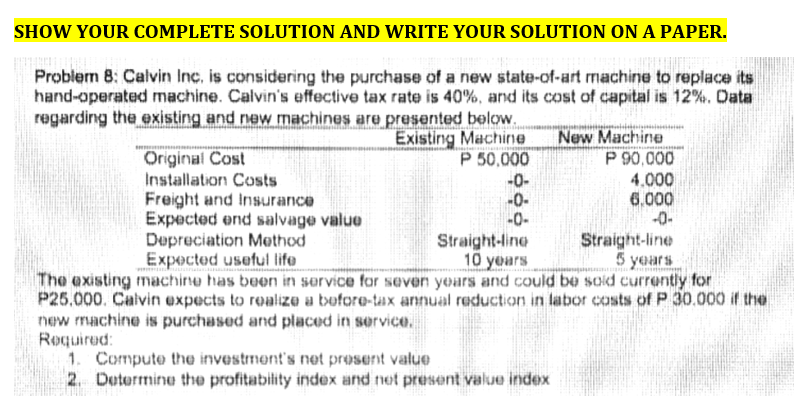

SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 8: Calvin Inc, is considering the purchase of a new state-of-art machine to replace its hand-operated machine. Calvin's effective tax rate is 40%, and its cost of capital is 12%, Data regarding the existing and new machines are presented below Existing Machine New Machine Original Cost P 50.000 P 90,000 Installation Costs 4.000 Freight and Insurance -0- 6.000 Expected and salvage value -O. Depreciation Method Straight-line Straight-line Expected useful life 10 yours 5 yours The existing machine has been in service for seven years and could be sold currently for P25,000. Calvin expects to realize a before-tax annual reduction in labor costs of P 30,000 if the new machine is purchased and placed in service. Required: 1. Compute the investment's net present value 2. Determine the profitability index and not present value index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts