Question: SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 2: Money Inc., has no debt outstanding and a total market value of

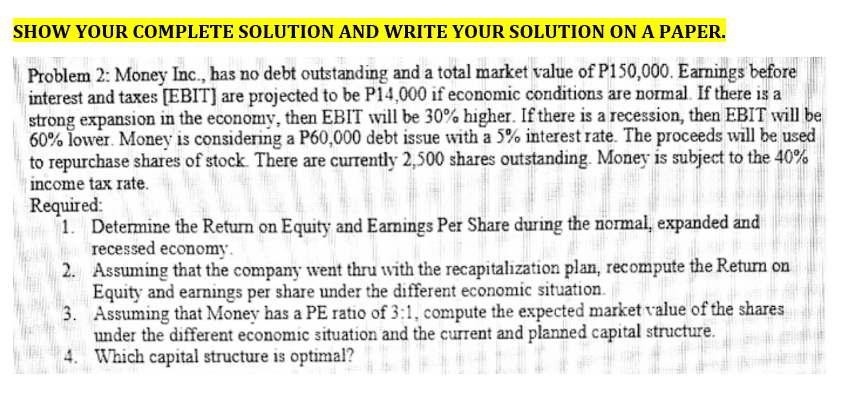

SHOW YOUR COMPLETE SOLUTION AND WRITE YOUR SOLUTION ON A PAPER. Problem 2: Money Inc., has no debt outstanding and a total market value of P150,000. Earnings before interest and taxes [EBIT] are projected to be P14,000 if economic conditions are normal. If there is a strong expansion in the economy, then EBIT will be 30% higher. If there is a recession, then EBIT will be 60% lower. Money is considering a P60,000 debt issue with a 5% interest rate. The proceeds will be used to repurchase shares of stock. There are currently 2,500 shares outstanding. Money is subject to the 40% income tax rate. Required: 1. Determine the Return on Equity and Earnings Per Share during the normal, expanded and recessed economy. 2. Assuming that the company went thru with the recapitalization plan, recompute the Return on Equity and earnings per share under the different economic situation. 3. Assuming that Money has a PE ratio of 3:1, compute the expected market value of the shares under the different economic situation and the current and planned capital structure. 4. Which capital structure is optimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts