Question: Hello, I need help with this and I would really appreciate if you can provide detailed explanations in order for me to do another assignment

Hello, I need help with this and I would really appreciate if you can provide detailed explanations in order for me to do another assignment based off this. please note that for the financial information for 2024, the prompt says that the sales are expected to grow at 20% for the enxt 3 years before settling at 7%

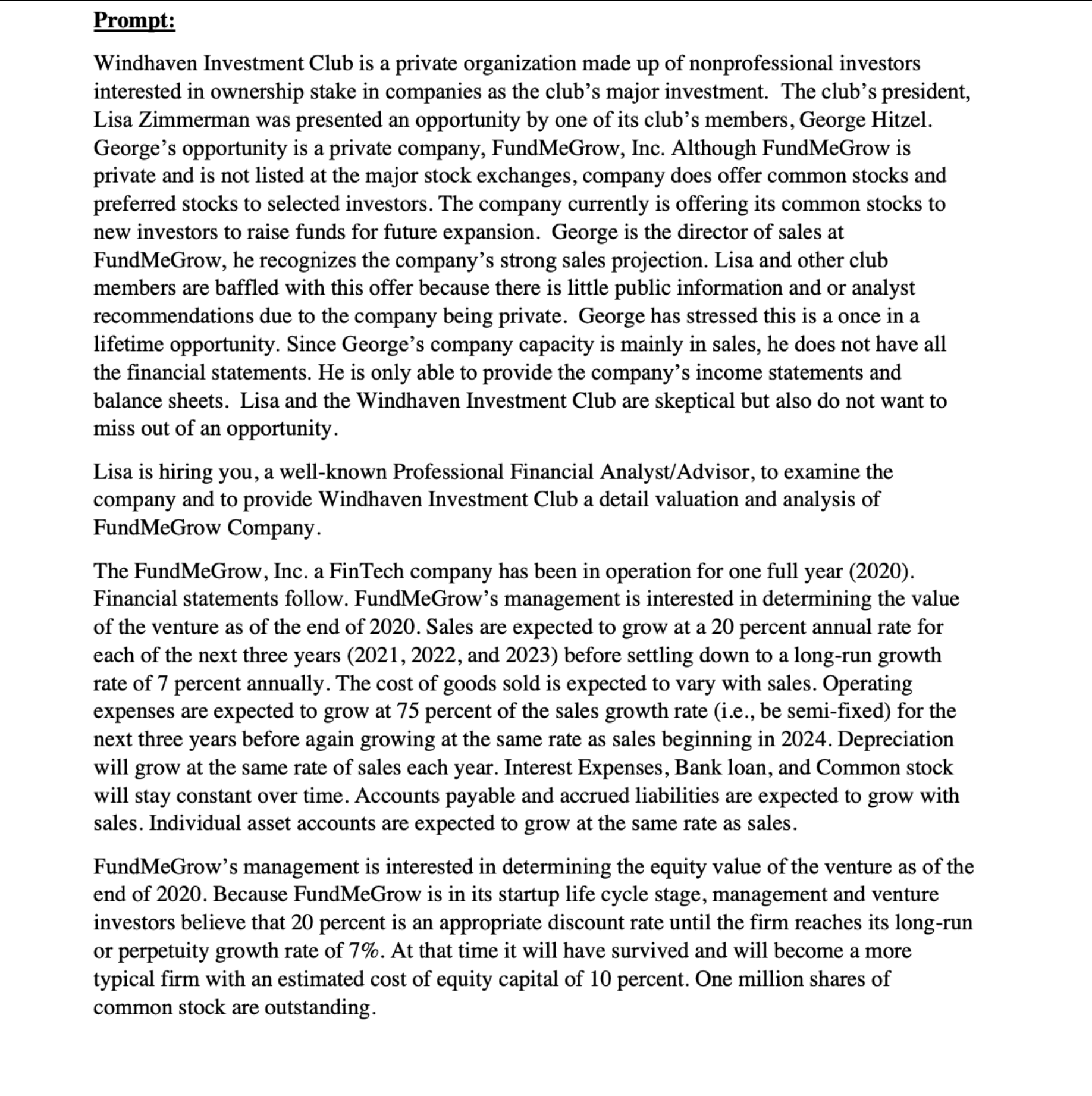

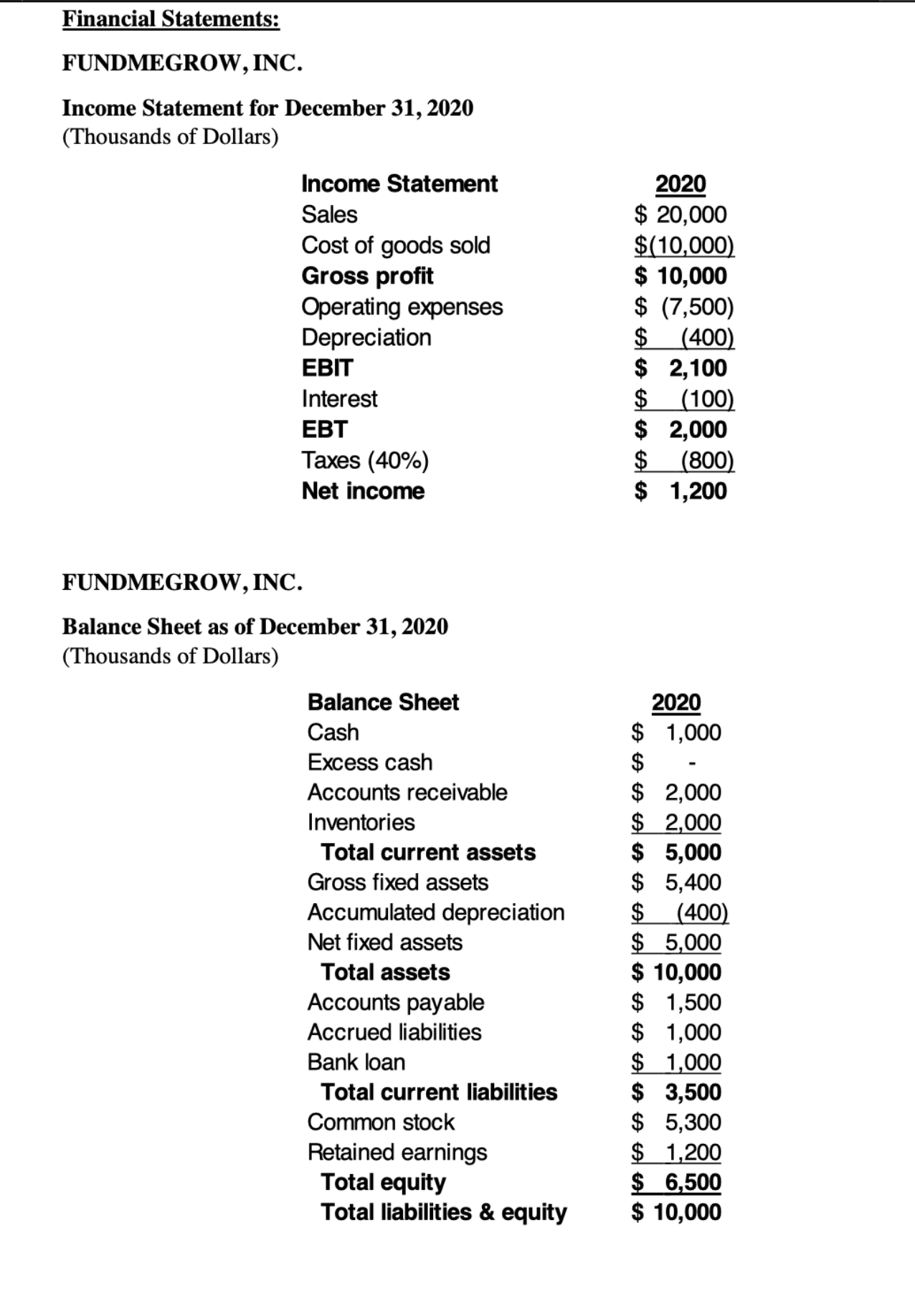

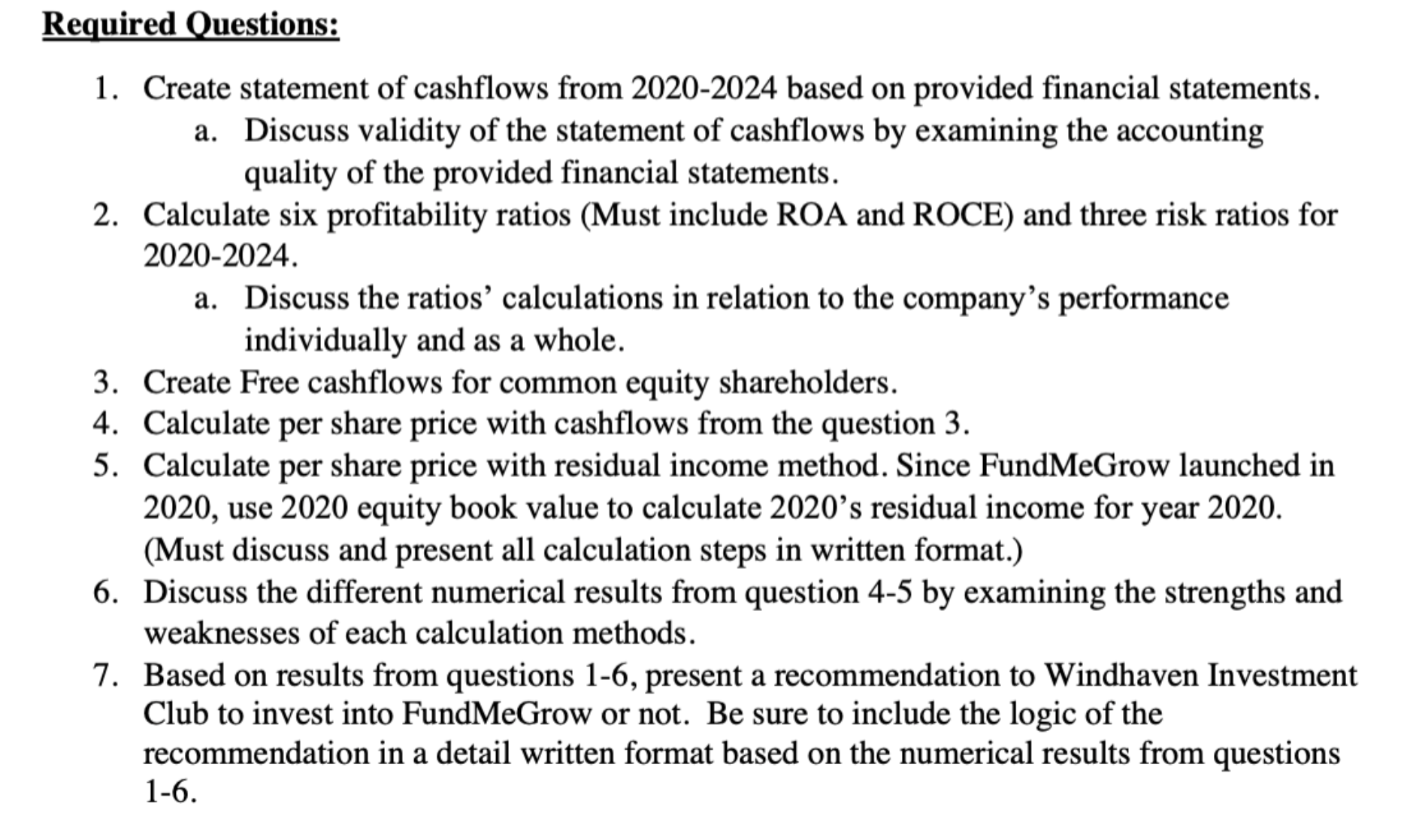

Prompt: Windhaven Investment Club is a private organization made up of nonprofessional investors interested in ownership stake in companies as the club's major investment. The club's president, Lisa Zimmerman was presented an opportunity by one of its club's members, George Hitzel. George's opportunity is a private company, FundMeGrow, Inc. Although FundMeGrow is private and is not listed at the major stock exchanges, company does offer common stocks and preferred stocks to selected investors. The company currently is offering its common stocks to new investors to raise funds for future expansion. George is the director of sales at FundMeGrow, he recognizes the company's strong sales projection. Lisa and other club members are bafed with this offer because there is little public information and or analyst recommendations due to the company being private. George has stressed this is a once in a lifetime opportunity. Since George's company capacity is mainly in sales, he does not have all the nancial statements. He is only able to provide the company's income statements and balance sheets. Lisa and the Windhaven Investment Club are skeptical but also do not want to miss out of an opportunity. Lisa is hiring you, a well-known Professional Financial Analyst/Advisor, to examine the company and to provide Windhaven Investment Club a detail valuation and analysis of FundMeGrow Company. The FundMeGrow, Inc. a FinTech company has been in operation for one full year (2020). Financial statements follow. FundMeGrow's management is interested in determining the value of the venture as of the end of 2020. Sales are expected to grow at a 20 percent annual rate for each of the next three years (2021, 2022, and 2023) before settling down to a long-run growth rate of 7 percent annually. The cost of goods sold is expected to vary with sales. Operating expenses are expected to grow at 75 percent of the sales growth rate (i .e., be semi-xed) for the next three years before again growing at the same rate as sales beginning in 2024. Depreciation will grow at the same rate of sales each year. Interest Expenses, Bank loan, and Common stock will stay constant over time. Accounts payable and accrued liabilities are expected to grow with sales. Individual asset accounts are expected to grow at the same rate as sales. FundMeGrow's management is interested in determining the equity value of the venture as of the end of 2020. Because FundMeGrow is in its startup life cycle stage, management and venture investors believe that 20 percent is an appropriate discount rate until the rm reaches its long-run or perpetuity growth rate of 7%. At that time it will have survived and will become a more typical rm with an estimated cost of equity capital of 10 percent. One million shares of common stock are outstanding. Financial Statements: FUNDMEGROW, INC. Income Statement for December 31, 2020 (Thousands of Dollars) Income Statement 2020 Sales $ 20,000 Cost of goods sold $ (10,000) Gross profit $ 10,000 Operating expenses $ (7,500) Depreciation (400) EBIT $ 2,100 Interest $ (100) EBT $ 2,000 Taxes (40%) $ (800) Net income $ 1,200 FUNDMEGROW, INC. Balance Sheet as of December 31, 2020 (Thousands of Dollars) Balance Sheet 2020 Cash EA 1,000 Excess cash Accounts receivable $ 2,000 Inventories $ 2,000 Total current assets 5,000 Gross fixed assets $ 5,400 Accumulated depreciation (400) Net fixed assets 5,000 Total assets $ 10,000 Accounts payable $ 1,500 Accrued liabilities $ 1,000 Bank loan $ 1,000 Total current liabilities $ 3,500 Common stock $ 5,300 Retained earnings $ 1,200 Total equity $ 6,500 Total liabilities & equity $ 10,000Rguired Questions: 1. Create statement of cashows from 2020-2024 based on provided nancial statements. a. Discuss validity of the statement of cashflows by examining the accounting quality of the provided nancial statements. 2. Calculate six profitability ratios (Must include RCA and ROCE) and three risk ratios for 2020-2024. a. Discuss the ratios' calculations in relation to the company's performance individually and as a whole. Create Free cashows for common equity shareholders. Calculate per share price with cashflows from the question 3. 5. Calculate per share price with residual income method. Since FundMeGrow launched in 2020, use 2020 equity book value to calculate 2020's residual income for year 2020. (Must discuss and present all calculation steps in written format.) 6. Discuss the different numerical results from question 4-5 by examining the strengths and weaknesses of each calculation methods. 7. Based on results from questions 1-6, present a recommendation to Windhaven Investment Club to invest into FundMeGrow or not. Be sure to include the logic of the recommendation in a detail written format based on the numerical results from questions 1-6. PS\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts