Question: Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write

Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write down your inputs for partial marks. Keep at least 4 decimal digits in all your calculation and answers unless specified otherwise. Make sure your work is legible

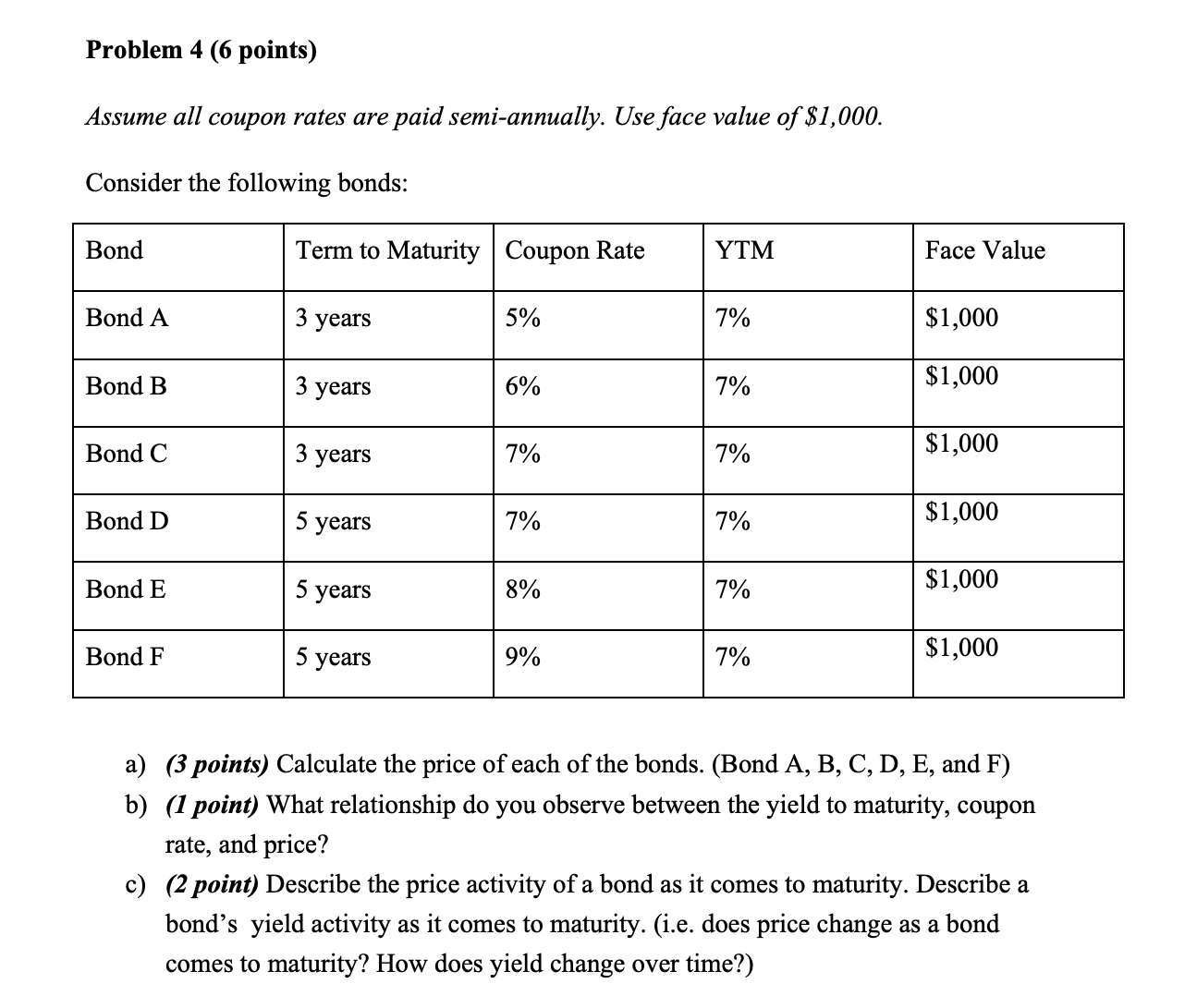

Assume all coupon rates are paid semi-annually. Use face value of \$1,000. Consider the following bonds: a) (3 points) Calculate the price of each of the bonds. (Bond A, B, C, D, E, and F) b) (1 point) What relationship do you observe between the yield to maturity, coupon rate, and price? c) (2 point) Describe the price activity of a bond as it comes to maturity. Describe a bond's yield activity as it comes to maturity. (i.e. does price change as a bond comes to maturity? How does yield change over time?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts