Question: Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write

Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write down your inputs for partial marks. Keep at least 4 decimal digits in all your calculation and answers unless specified otherwise. Make sure your work is legible.

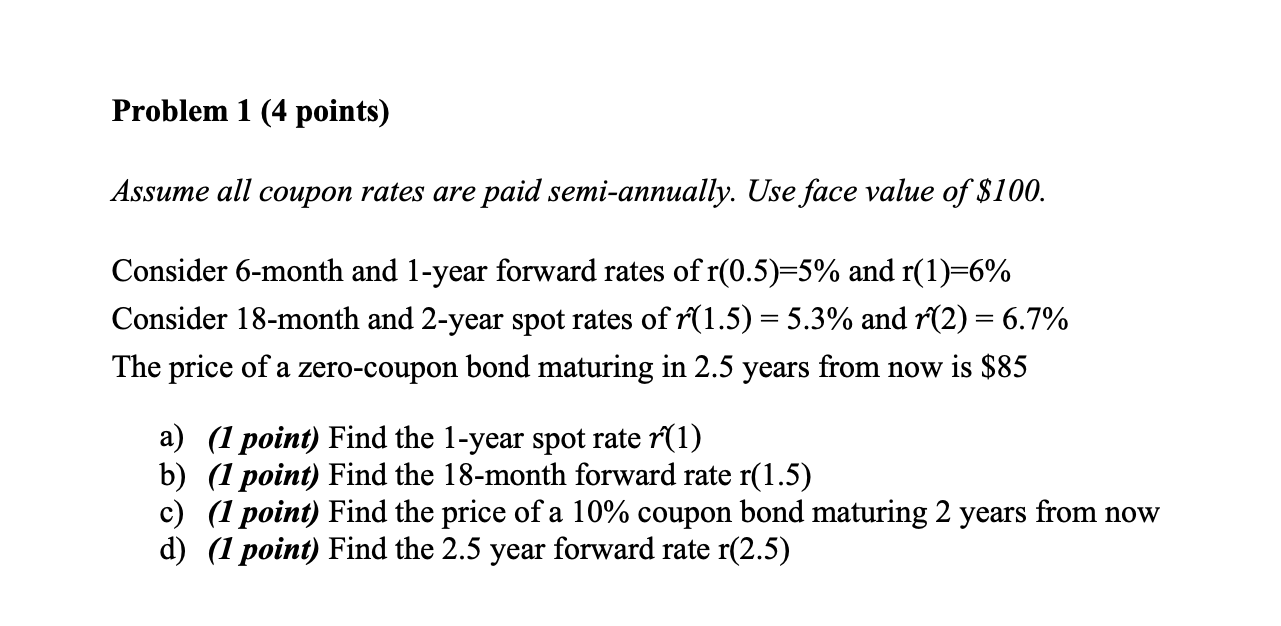

Assume all coupon rates are paid semi-annually. Use face value of $100. Consider 6-month and 1-year forward rates of r(0.5)=5% and r(1)=6% Consider 18-month and 2-year spot rates of r(1.5)=5.3% and r(2)=6.7% The price of a zero-coupon bond maturing in 2.5 years from now is $85 a) (1 point) Find the 1-year spot rate r(1) b) (1 point) Find the 18-month forward rate r(1.5) c) (1 point) Find the price of a 10\% coupon bond maturing 2 years from now d) (1 point) Find the 2.5 year forward rate r(2.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts