Question: Show your work please: 1. Assume that A and B are two subsidiaries of company AB and that they are based in different countries. A

Show your work please:

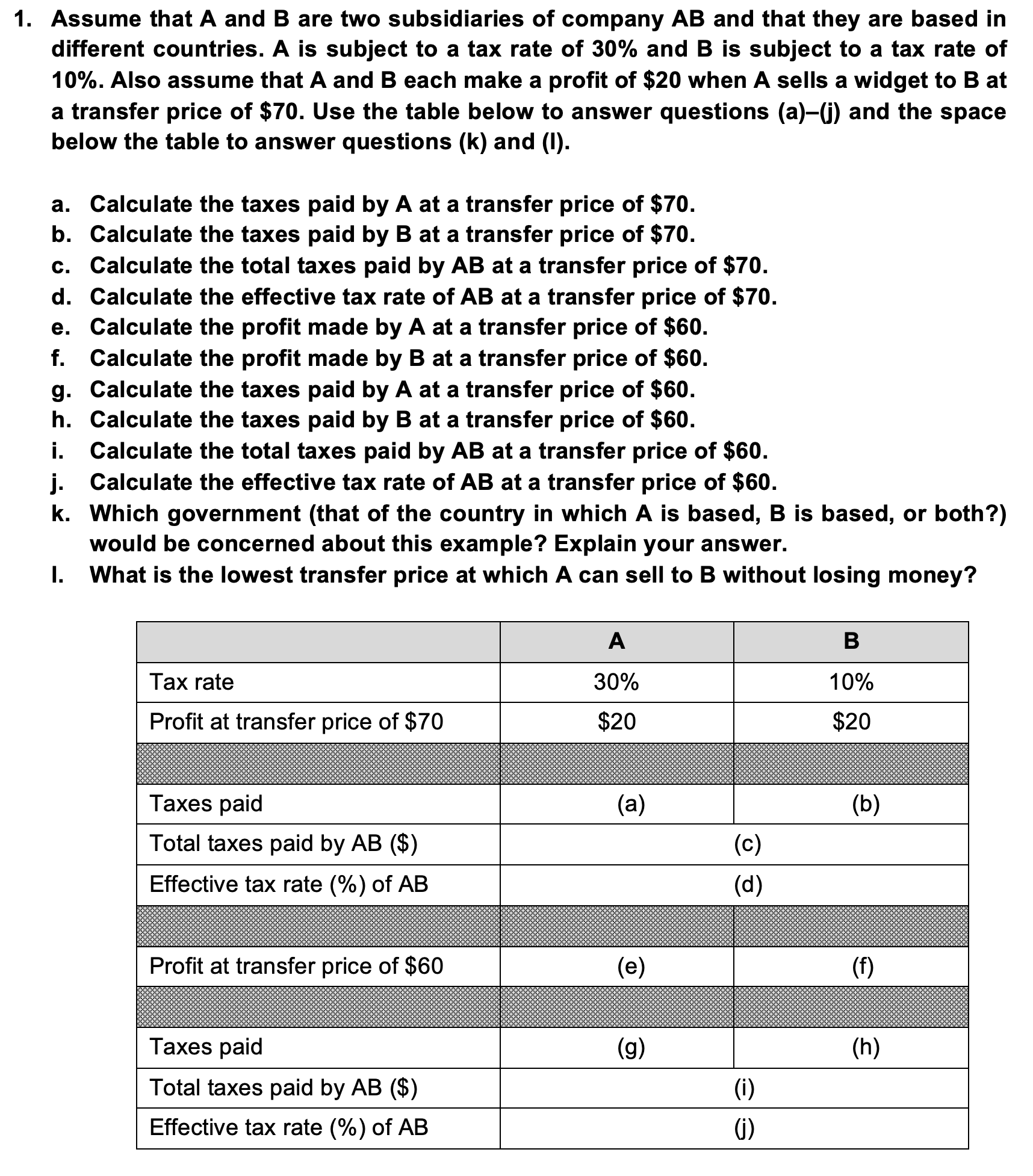

1. Assume that A and B are two subsidiaries of company AB and that they are based in different countries. A is subject to a tax rate of 30% and B is subject to a tax rate of 10%. Also assume that A and B each make a profit of $20 when A sells a widget to B at a transfer price of $70. Use the table below to answer questions (a)(j) and the space below the table to answer questions (k) and (I). r'r'r'FtP-'hsnepp'sv Calculate the taxes paid by A at a transfer price of $70. Calculate the taxes paid by B at a transfer price of $70. Calculate the total taxes paid by AB at a transfer price of $70. Calculate the effective tax rate of AB at a transfer price of $70. Calculate the profit made by A at a transfer price of $60. Calculate the profit made by B at a transfer price of $60. Calculate the taxes paid by A at a transfer price of $60. Calculate the taxes paid by B at a transfer price of $60. Calculate the total taxes paid by AB at a transfer price of $60. Calculate the effective tax rate of AB at a transfer price of $60. Which government (that of the country in which A is based, B is based, or both?) would be concerned about this example? Explain your answer. What is the lowest transfer price at which A can sell to B without losing money? Tax rate Profit at transfer price of $70 Taxes paid Total taxes paid by AB ($) Effective tax rate (/ ) of AB Profit at transfer price of $60 Taxes paid Total taxes paid by AB ($) (i) Effective tax rate (%) of AB (j)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts