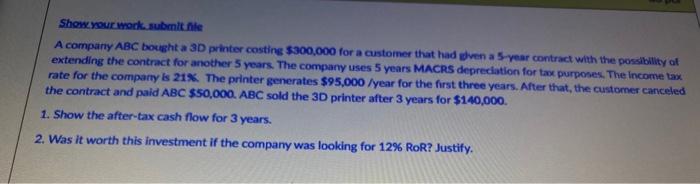

Question: Show your work submit le A company ABC bought a 3D printer costing $300,000 for a customer that had even a 5-year contract with the

Show your work submit le A company ABC bought a 3D printer costing $300,000 for a customer that had even a 5-year contract with the possibility at extending the contract for another 5 years. The company uses 5 years MACRS depreciation for tax purposes. The income tax rate for the company is 21%. The printer generates $95,000/year for the first three years. After that, the customer canceled the contract and paid ABC $50,000. ABC sold the 3D printer after 3 years for $140,000 1. Show the after-tax cash flow for 3 years. 2. Was it worth this investment if the company was looking for 12% RoR? Justify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts