Question: show yoyr calculation 1 points A firm has a return on equity of 12.4 percent according to the dividend growth model and a return of

show yoyr calculation

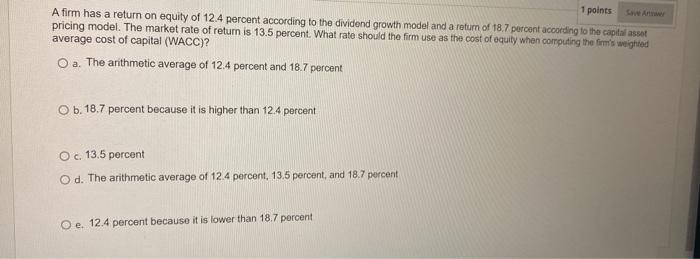

1 points A firm has a return on equity of 12.4 percent according to the dividend growth model and a return of 18.7 percent according to the capital asset pricing model. The market rate of return is 13.5 percent. What rate should the firm use as the cost of equity when computing the firm's weighted average cost of capital (WACC)? O a. The arithmetic average of 12.4 percent and 18.7 percent O b. 18.7 percent because it is higher than 12.4 percent O c. 13.5 percent Od. The arithmetic average of 12.4 percent, 13.5 percent, and 18.7 percent O e. 12.4 percent because it is lower than 18.7 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock