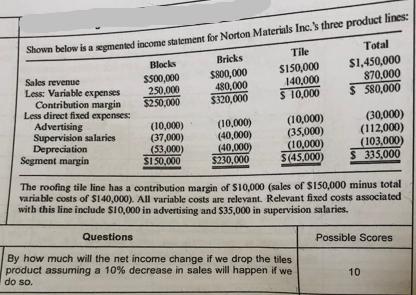

Question: Shown below is a segmented income statement for Norton Materials Inc.'s three product lines: Total Blocks Tile Bricks $500,000 $800,000 $150,000 $1,450,000 870,000 250,000

Shown below is a segmented income statement for Norton Materials Inc.'s three product lines: Total Blocks Tile Bricks $500,000 $800,000 $150,000 $1,450,000 870,000 250,000 480,000 140,000 $250,000 $320,000 $ 10,000 $ 580,000 Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Advertising Supervision salaries Depreciation Segment margin (10,000) (37,000) (53,000) $150,000 (10,000) (40,000) (40,000) $230,000 (10,000) (35,000) (10,000) $(45,000) (30,000) (112,000) (103,000) S 335,000 The roofing tile line has a contribution margin of $10,000 (sales of $150,000 minus total variable costs of $140,000). All variable costs are relevant. Relevant fixed costs associated with this line include $10,000 in advertising and $35,000 in supervision salaries. Questions By how much will the net income change if we drop the tiles product assuming a 10% decrease in sales will happen if we do so. Possible Scores 10

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Calculate the change in net income if the tile product is dropped and a ... View full answer

Get step-by-step solutions from verified subject matter experts