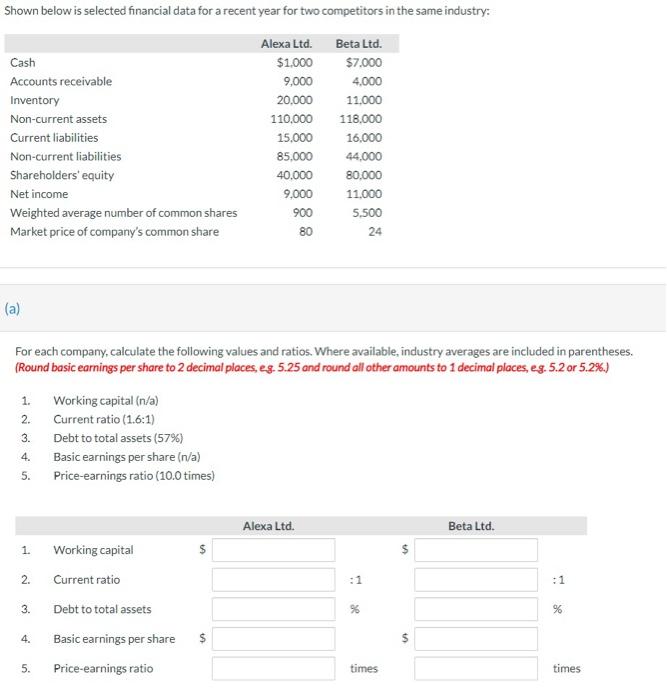

Question: Shown below is selected financial data for a recent year for two competitors in the same industry: Alexa Ltd. Beta Ltd. Cash $1,000 $7.000 Accounts

Shown below is selected financial data for a recent year for two competitors in the same industry: Alexa Ltd. Beta Ltd. Cash $1,000 $7.000 Accounts receivable 9,000 4.000 Inventory 20,000 11.000 Non-current assets 110,000 118.000 Current liabilities 15,000 16,000 Non-current liabilities 85,000 44,000 Shareholders' equity 40.000 80.000 Net income 9,000 11.000 Weighted average number of common shares 900 5,500 Market price of company's common share 24 (a) For each company, calculate the following values and ratios. Where available, industry averages are included in parentheses. (Round basic earnings per share to 2 decimal places, eg. 5.25 and round all other amounts to 1 decimal places, eg. 5.2 or 5.2%.) 1. 2. 3. 4. 5. Working capital (n/a) Current ratio (1.6:1) Debt to total assets (57%) Basic earnings per share (n/a) Price-earnings ratio (10.0 times) Alexa Ltd. Beta Ltd. 1. Working capital 2. :1 Current ratio Debt to total assets 3. % % 4. Basic earnings per share $ $ 5. Price-earnings ratio times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts