Question: Shown below is the information needed to prepare the bank reconciliation for X Company at December 31, 2020 1. At December 31st, cash per

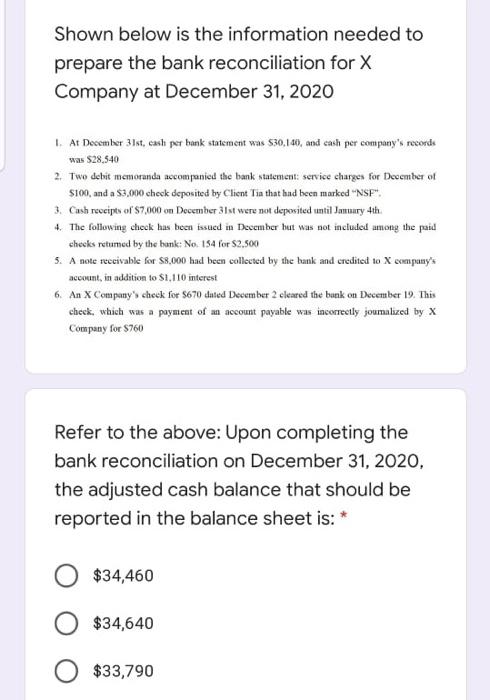

Shown below is the information needed to prepare the bank reconciliation for X Company at December 31, 2020 1. At December 31st, cash per bank statement was $30,140, and cash per company's records was $28,540 2. Two debit memoranda accompanied the bank statement: service charges for December of $100, and a $3,000 check deposited by Client Tia that had been marked "NSF". 3. Cash receipts of $7,000 on December 31st were not deposited until January 4th. 4. The following check has been issued in December but was not included among the paid checks retumed by the bank: No. 154 for $2,500 5. A note receivable for $8,000 had been collected by the bank and credited to X company's account, in addition to $1,110 interest 6. An X Company's check for $670 dated December 2 cleared the bank on December 19. This check, which was a payment of an account payable was incorrectly joumalized by X Company for $760 Refer to the above: Upon completing the bank reconciliation on December 31, 2020, the adjusted cash balance that should be reported in the balance sheet is: * $34,460 $34,640 $33,790

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts