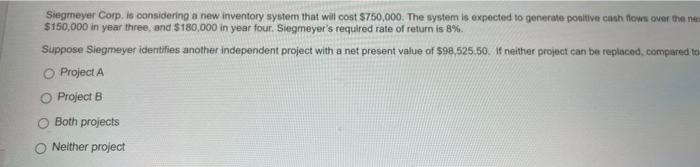

Question: Siegmeyer Corp. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the new $150,000

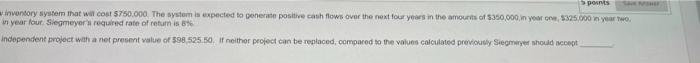

Siegmeyer Corp. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the new $150,000 in year three, and $180,000 in year four. Siegmeyer's required rate of return is 8% Suppose Siegmeyer identifies another independent project with a net present value of $98,525 50. If neither project can be replaced, compared to Project A Project B Both projects Neither project Sports inventory system that will cost 5750.000 The system is expected to generate positive cash flows over the next four years in the amounts of 350,000 in your one, 225.000 yearTwo in year four Slegmeyer required rate of return is 6% Independent project with a net present value of 598 525.50. if neither project can be replaced, compared to the values calculated previousy Siemeyer should not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts