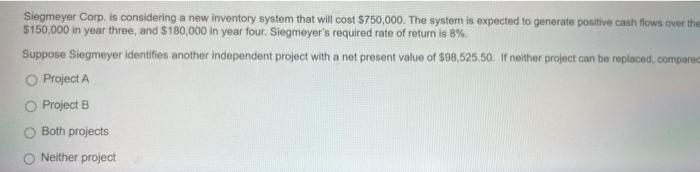

Question: Siegmeyer Corp. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the $150,000 in

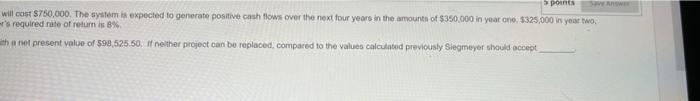

Siegmeyer Corp. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the $150,000 in year three, and $180,000 in year four, Siegmeyer's required rate of return is 8%. Suppose Siegmeyer identifies another independent project with a net present value of $98,525.50. If neither project can be replaced, compare Project A Project B O Both projects Neither project WEWE points will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year on, $325,000 in year two, r's required rate of return is 8% tha ne present value of 598,525,50, if neither project can be replaced, compared to the values calculated previously Siegmeyer should accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts