Question: Similar to the example in class when I discussed Is it bankruptcy or bankruptcy costs, the following table shows asset, debt, and equity time

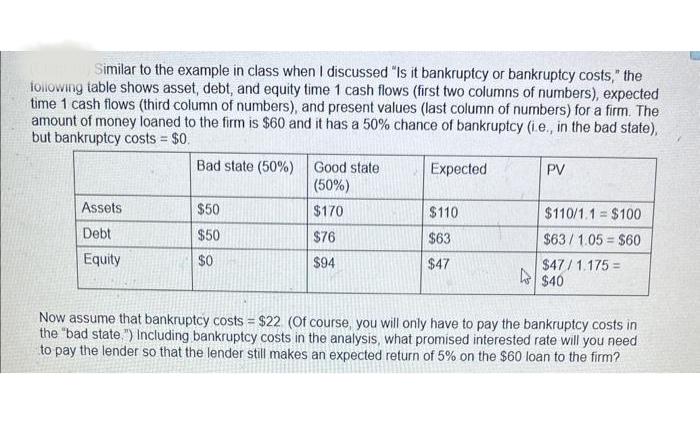

Similar to the example in class when I discussed "Is it bankruptcy or bankruptcy costs," the following table shows asset, debt, and equity time 1 cash flows (first two columns of numbers), expected time 1 cash flows (third column of numbers), and present values (last column of numbers) for a firm. The amount of money loaned to the firm is $60 and it has a 50% chance of bankruptcy (i.e., in the bad state), but bankruptcy costs = $0. Bad state (50%) Assets Debt Equity $50 $50 $0 Good state (50%) $170 $76 $94 Expected $110 $63 $47 PV $110/1.1 $100 $63/1.05= $60 $47/1.175= $40 Now assume that bankruptcy costs = $22. (Of course, you will only have to pay the bankruptcy costs in the "bad state.") Including bankruptcy costs in the analysis, what promised interested rate will you need to pay the lender so that the lender still makes an expected return of 5% on the $60 loan to the firm?

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

To calculate the promised interest rate that the lender will need to receive to make an exp... View full answer

Get step-by-step solutions from verified subject matter experts