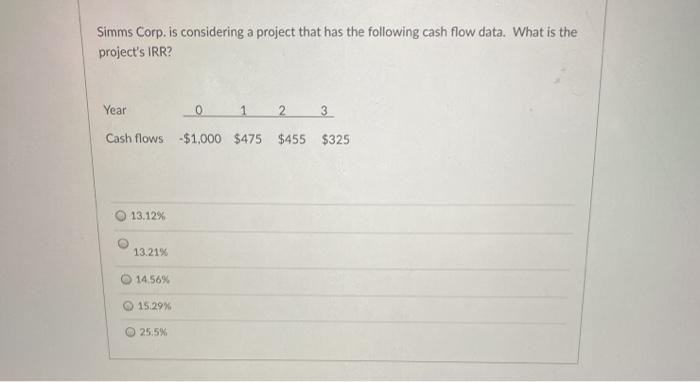

Question: Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Year 0 2 3 Cash flows -$1,000

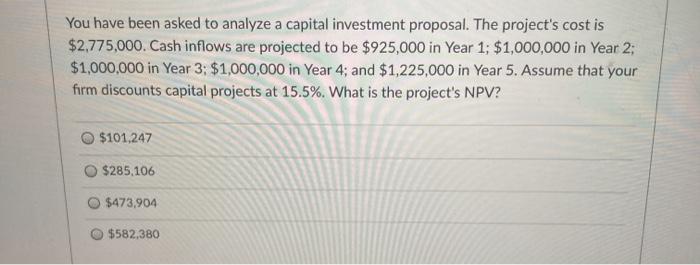

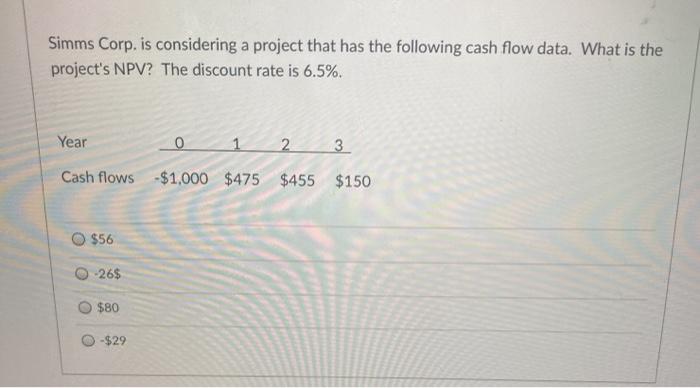

Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Year 0 2 3 Cash flows -$1,000 $475 $455 $325 13.12% 13.21% O 14.56% 15.29% 25.5% You have been asked to analyze a capital investment proposal. The project's cost is $2,775,000. Cash inflows are projected to be $925,000 in Year 1; $1,000,000 in Year 2; $1,000,000 in Year 3: $1,000,000 in Year 4; and $1,225,000 in Year 5. Assume that your form discounts capital projects at 15.5%. What is the project's NPV? $101.247 $285,106 $473,904 $582,380 Simms Corp. is considering a project that has the following cash flow data. What is the project's NPV? The discount rate is 6.5%. Year 2 3 Cash flows -$1,000 $475 $455 $150 $56 -26$ $80 -$29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts