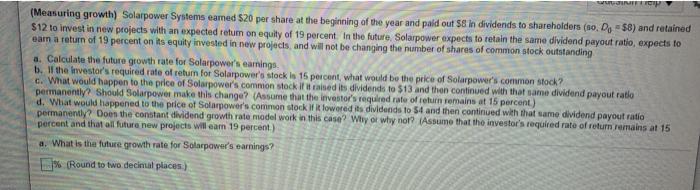

Question: SINIF (Measuring growth) Solarpower Systems eamed $20 per share at the beginning of the year and paid out 58 in dividends to shareholders (50. Do

SINIF (Measuring growth) Solarpower Systems eamed $20 per share at the beginning of the year and paid out 58 in dividends to shareholders (50. Do $8) and retained $12 to invest in new projects with an expected retum on equity of 19 percent. In the future. Solarpower expects to retain the same dividend payout ratio, expects to earn a return of 19 percent on its equity invested in new projects, and will not be changing the number of shares of common stock outstanding a. Calculate the future growth rate for Solarpower's earnings b. If the investor's required rate of return for Solarpower's stock is 15 percent, what would be the price of Solarpower's common stock? c. What would happen to the price of Solarpower's common stock if it raised its dividends to 513 and then continued with that same dividend payout ratio permanently? Should Solarpower make this change? (Assume that the investor's required rate of return remains at 15 percent) d. What would happened to the price of Solarpower's common stock if lowered its dividends to 54 and then continued with that same dividend payout ratio permanently? Doen the constant dividend growth rate model work in this case? Why or why not? Assume that the investor's required rate of return remains at 15 percent and that all future new projects will eam 19 percent) a. What is the future growth rate for Solarpawer's earnings? % (Round to two decinal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts