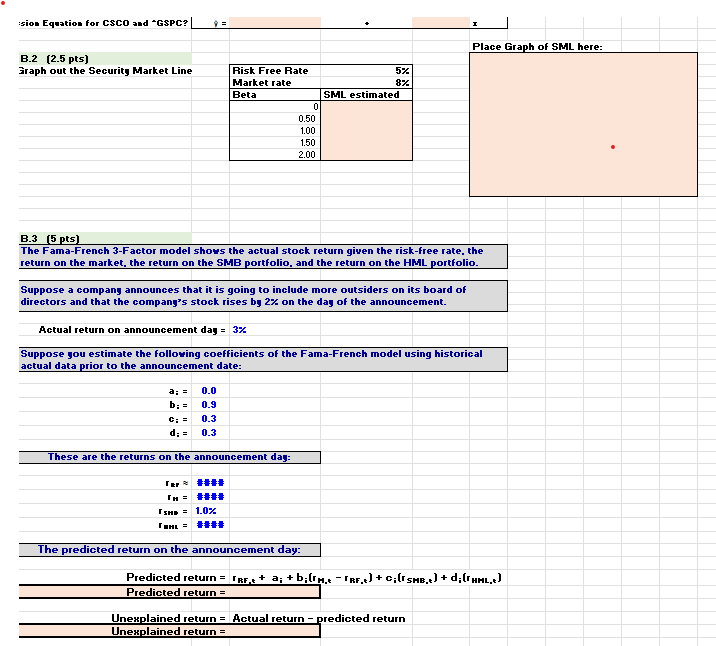

Question: sios Equation for CSCO and GSPC? 9 = Place Graph of SML here: B.2 (2.5 pts) Graph out the Security Market Line Risk Free Rate

sios Equation for CSCO and GSPC? 9 = Place Graph of SML here: B.2 (2.5 pts) Graph out the Security Market Line Risk Free Rate 5% Market rate 87 Beta SML estimated 0 0.50 1.00 1.50 2.00 B.3 (5 pts) The Fama-French 3-Factor model shows the actual stock return given the risk-free rate, the return on the market, the return on the SMB portfolio, and the return on the HML portfolio. Suppose a company announces that it is going to include more outsiders on its board of directors and that the company's stock rises by 2% on the day of the announcement. Actual return on announcement day = 32 Suppose you estimate the following coefficients of the Fama-French model using historical actual data prior to the announcement date: b;= C:= d; = 0.0 0.9 0.3 0.3 These are the returns on the announcement day: Tar ### THE ### SHE = 1.0% THE = ++ The predicted return on the announcement day: + Predicted return = [BF + a;+b;(n -TRF.c)+c;( SHB.c) + d; (THAL.) Predicted return = Unexplained return = Actual return - predicted return Unexplained return = sios Equation for CSCO and GSPC? 9 = Place Graph of SML here: B.2 (2.5 pts) Graph out the Security Market Line Risk Free Rate 5% Market rate 87 Beta SML estimated 0 0.50 1.00 1.50 2.00 B.3 (5 pts) The Fama-French 3-Factor model shows the actual stock return given the risk-free rate, the return on the market, the return on the SMB portfolio, and the return on the HML portfolio. Suppose a company announces that it is going to include more outsiders on its board of directors and that the company's stock rises by 2% on the day of the announcement. Actual return on announcement day = 32 Suppose you estimate the following coefficients of the Fama-French model using historical actual data prior to the announcement date: b;= C:= d; = 0.0 0.9 0.3 0.3 These are the returns on the announcement day: Tar ### THE ### SHE = 1.0% THE = ++ The predicted return on the announcement day: + Predicted return = [BF + a;+b;(n -TRF.c)+c;( SHB.c) + d; (THAL.) Predicted return = Unexplained return = Actual return - predicted return Unexplained return =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts