Question: Situation: On December 3 1 , 2 0 X 5 , Pound Inc purchased 2 5 % of the shares of Sound Ltd .

Situation:

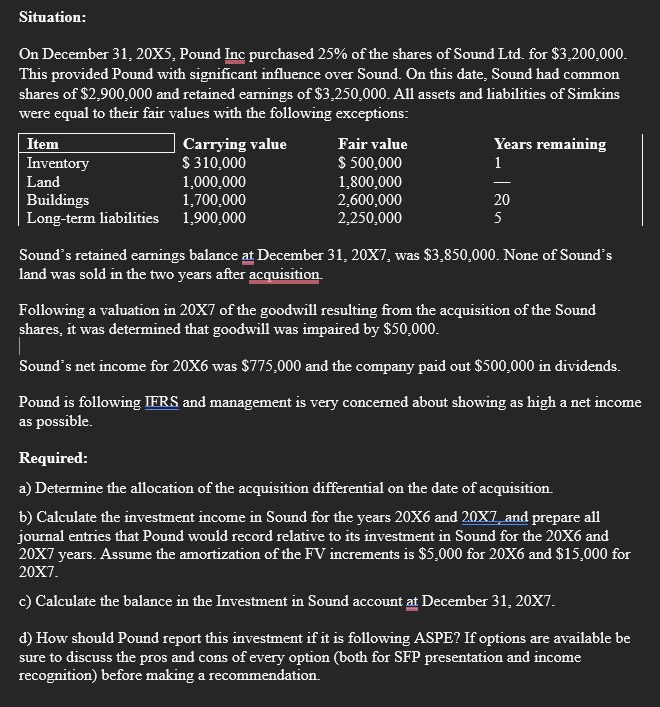

On December X Pound Inc purchased of the shares of Sound Ltd for $ This provided Pound with significant influence over Sound. On this date, Sound had common shares of $ and retained earnings of $ All assets and liabilities of Simkins were equal to their fair values with the following exceptions:

Sound's retained earnings balance at December X was $ None of Sound's land was sold in the two years after acquisition.

Following a valuation in X of the goodwill resulting from the acquisition of the Sound shares, it was determined that goodwill was impaired by $

Sound's net income for X was $ and the company paid out $ in dividends.

Pound is following IFRS and management is very concerned about showing as high a net income as possible.

Required:

a Determine the allocation of the acquisition differential on the date of acquisition.

b Calculate the investment income in Sound for the years X and X and prepare all journal entries that Pound would record relative to its investment in Sound for the X and X years. Assume the amortization of the FV increments is $ for X and $ for X

c Calculate the balance in the Investment in Sound account at December X

d How should Pound report this investment if it is following ASPE? If options are available be sure to discuss the pros and cons of every option both for SFP presentation and income recognition before making a recommendation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock