Question: (SK1, SK2, SD1:10 X 1 Mark - 10 Marks the discount 1. Generally, the the uncertainty about an asset's future benefits, the rate investors will

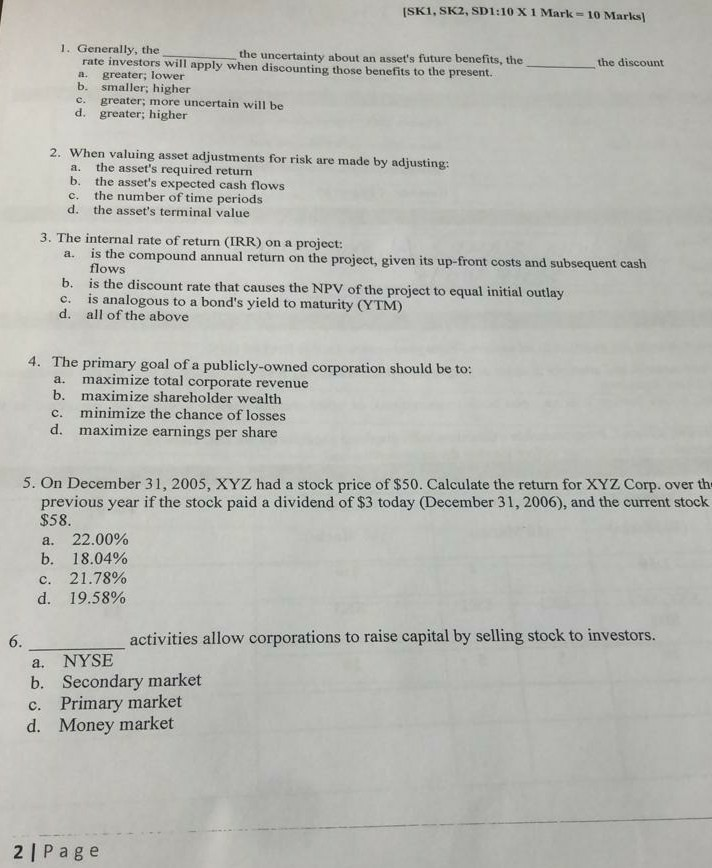

(SK1, SK2, SD1:10 X 1 Mark - 10 Marks the discount 1. Generally, the the uncertainty about an asset's future benefits, the rate investors will apply when discounting those benefits to the present. a greater; lower b. smaller; higher c. greater; more uncertain will be d. greater; higher 2. When valuing asset adjustments for risk are made by adjusting: a. the asset's required return b. the asset's expected cash flows c. the number of time periods d. the asset's terminal value 3. The internal rate of return (IRR) on a project: a. is the compound annual return on the project, given its up-front costs and subsequent cash flows b. is the discount rate that causes the NPV of the project to equal initial outlay c. is analogous to a bond's yield to maturity (YTM) d. all of the above 4. The primary goal of a publicly-owned corporation should be to: a. maximize total corporate revenue b. maximize shareholder wealth c. minimize the chance of losses d. maximize earnings per share 5. On December 31, 2005, XYZ had a stock price of $50. Calculate the return for XYZ Corp. over the previous year if the stock paid a dividend of $3 today (December 31, 2006), and the current stock $58. a. 22.00% b. 18.04% c. 21.78% d. 19.58% 6. activities allow corporations to raise capital by selling stock to investors. a. NYSE b. Secondary market c. Primary market d. Money market 2 Page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock