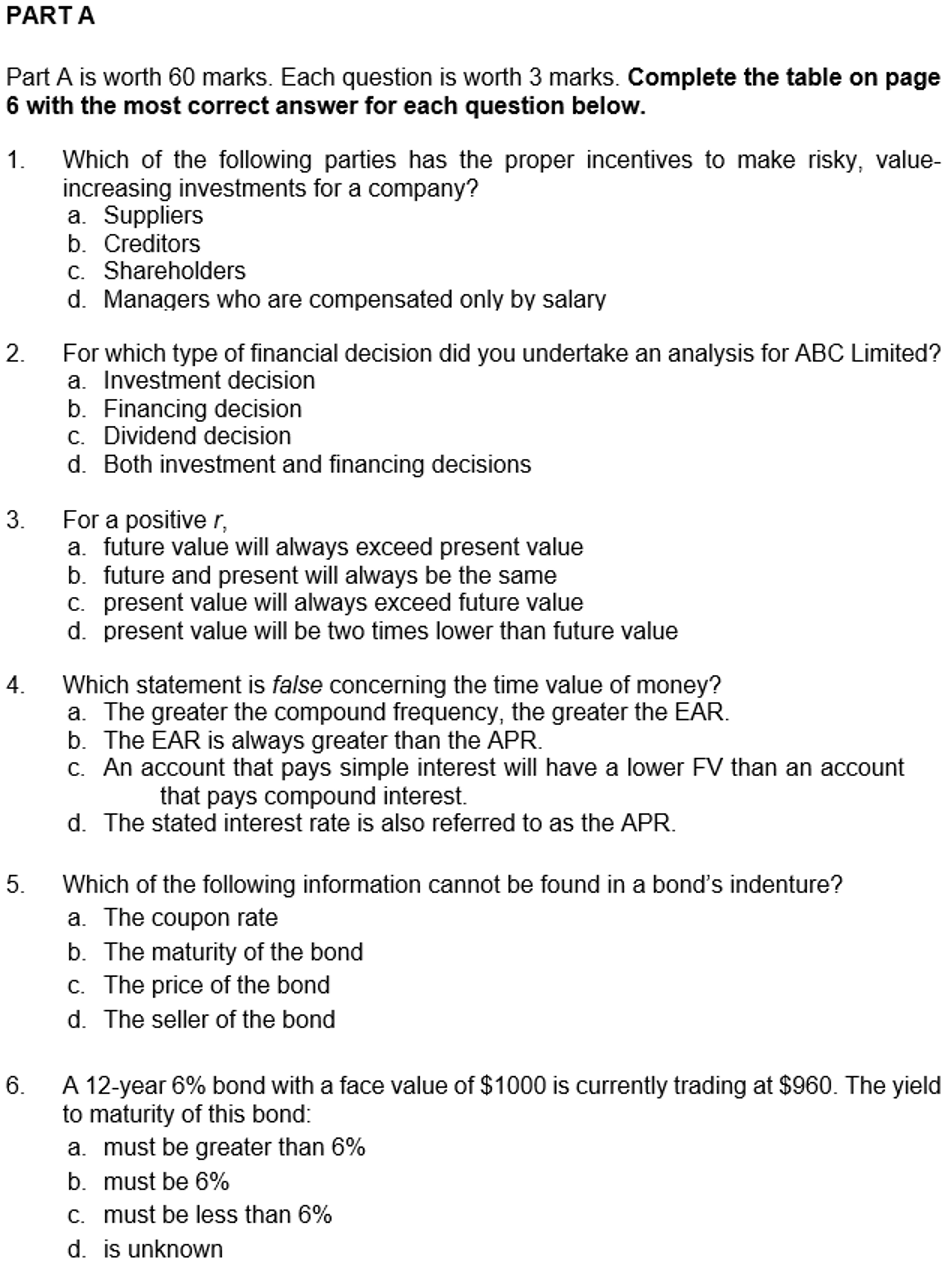

Question: PARTA Part A is worth 60 marks. Each question is worth 3 marks. Complete the table on page 6 with the most correct answer for

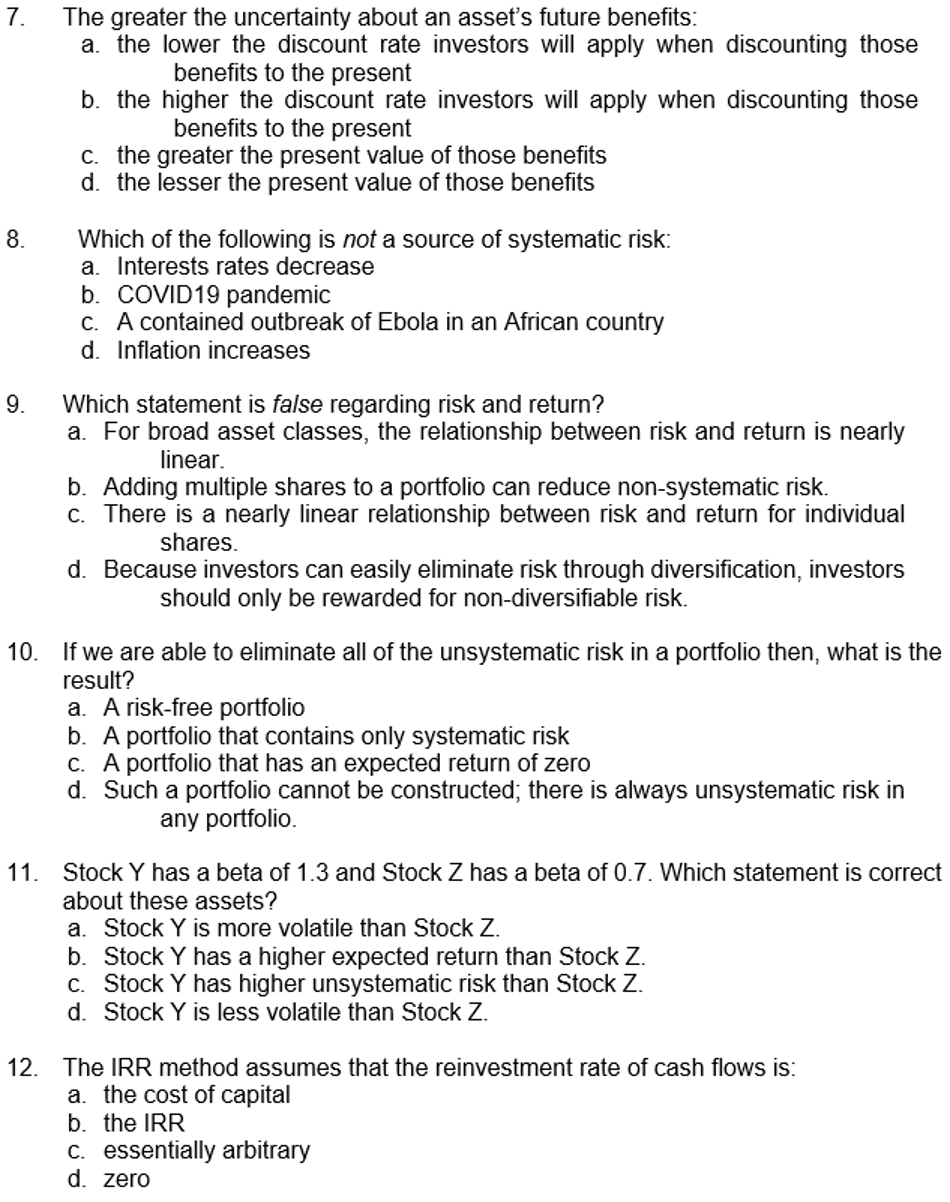

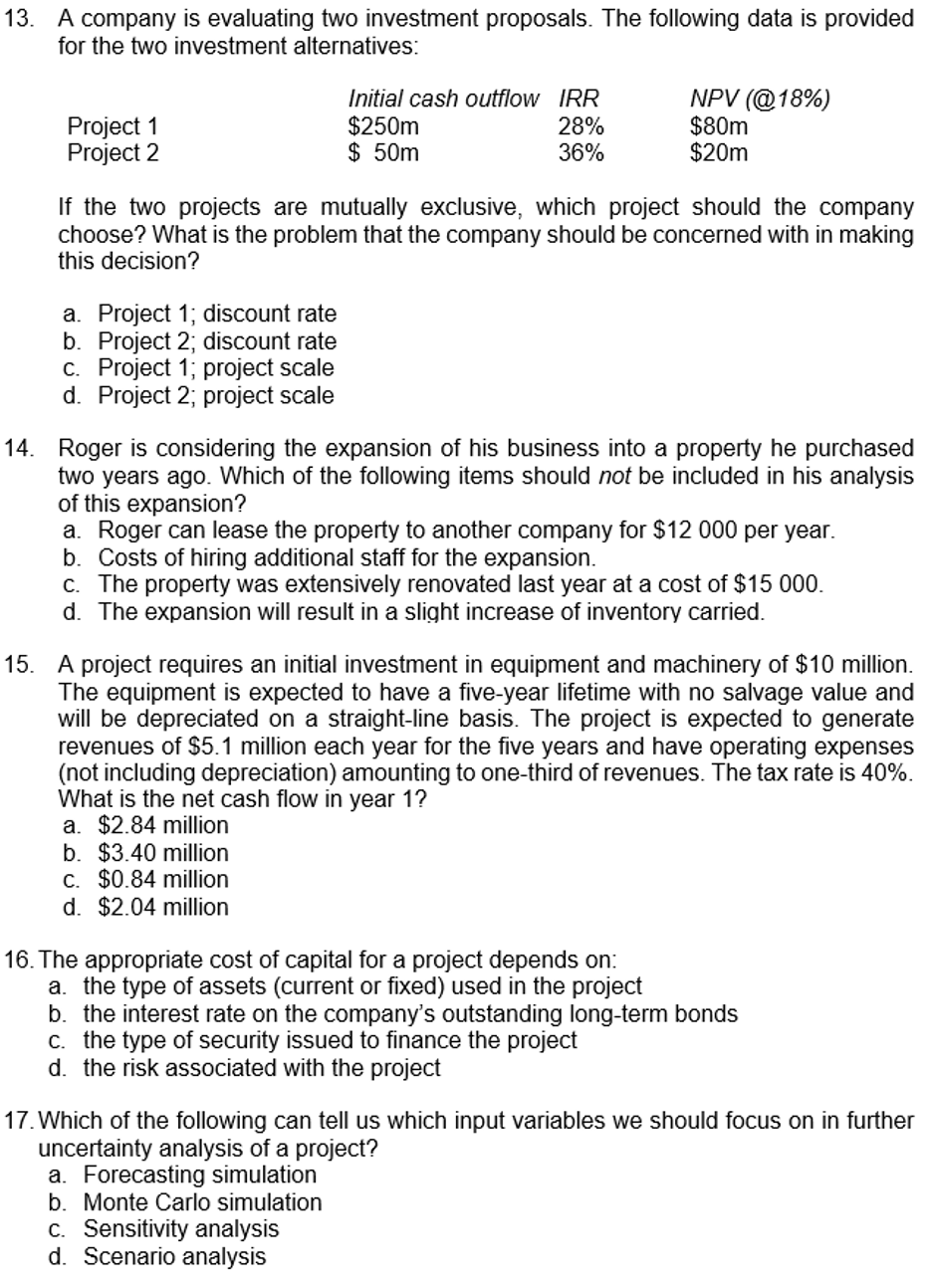

PARTA Part A is worth 60 marks. Each question is worth 3 marks. Complete the table on page 6 with the most correct answer for each question below. 1. Which of the following parties has the proper incentives to make risky, value- increasing investments for a company? a. Suppliers b. Creditors C. Shareholders d. Managers who are compensated only by salary 2. For which type of financial decision did you undertake an analysis for ABC Limited? a. Investment decision b. Financing decision C. Dividend decision d. Both investment and financing decisions 3. For a positiver, a. future value will always exceed present value b. future and present will always be the same C. present value will always exceed future value d. present value will be two times lower than future value 4. Which statement is false concerning the time value of money? a. The greater the compound frequency, the greater the EAR. b. The EAR is always greater than the APR. C. An account that pays simple interest will have a lower FV than an account that pays compound interest. d. The stated interest rate is also referred to as the APR. 5. Which of the following information cannot be found in a bond's indenture? a. The coupon rate b. The maturity of the bond C. The price of the bond d. The seller of the bond 6. A 12-year 6% bond with a face value of $1000 is currently trading at $960. The yield to maturity of this bond: a. must be greater than 6% b. must be 6% C. must be less than 6% d. is unknown 7. The greater the uncertainty about an asset's future benefits: a. the lower the discount rate investors will apply when discounting those benefits to the present b. the higher the discount rate investors will apply when discounting those benefits to the present C. the greater the present value of those benefits d. the lesser the present value of those benefits 8. Which of the following is not a source of systematic risk: a. Interests rates decrease b. COVID19 pandemic C. A contained outbreak of Ebola in an African country d. Inflation increases 9. Which statement is false regarding risk and return? a. For broad asset classes, the relationship between risk and return is nearly linear. b. Adding multiple shares to a portfolio can reduce non-systematic risk. C. There is a nearly linear relationship between risk and return for individual shares. d. Because investors can easily eliminate risk through diversification, investors should only be rewarded for non-diversifiable risk. 10. If we are able to eliminate all of the unsystematic risk in a portfolio then, what is the result? a. A risk-free portfolio b. A portfolio that contains only systematic risk C. A portfolio that has an expected return of zero d. Such a portfolio cannot be constructed; there is always unsystematic risk in any portfolio 11. Stock Y has a beta of 1.3 and Stock Z has a beta of 0.7. Which statement is correct about these assets? a. Stock Y is more volatile than Stock Z. b. Stock Y has a higher expected return than Stock Z. C. Stock Y has higher unsystematic risk than Stock Z. d. Stock Y is less volatile than Stock Z. 12. The IRR method assumes that the reinvestment rate of cash flows is: a. the cost of capital b. the IRR c. essentially arbitrary d. zero 13. A company is evaluating two investment proposals. The following data is provided for the two investment alternatives: Project 1 Project 2 Initial cash outflow IRR $250m 28% $ 50m 36% NPV (@18%) $80m $20m If the two projects are mutually exclusive, which project should the company choose? What is the problem that the company should be concerned with in making this decision? a. Project 1; discount rate b. Project 2, discount rate C. Project 1; project scale d. Project 2; project scale 14. Roger is considering the expansion of his business into a property he purchased two years ago. Which of the following items should not be included in his analysis of this expansion? a. Roger can lease the property to another company for $12 000 per year. b. Costs of hiring additional staff for the expansion. C. The property was extensively renovated last year at a cost of $15 000. d. The expansion will result in a slight increase of inventory carried. 15. A project requires an initial investment in equipment and machinery of $10 million. The equipment is expected to have a five-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate revenues of $5.1 million each year for the five years and have operating expenses (not including depreciation) amounting to one-third of revenues. The tax rate is 40%. What is the net cash flow in year 1? a $2.84 million b. $3.40 million C. $0.84 million d. $2.04 million 16. The appropriate cost of capital for a project depends on: a. the type of assets (current or fixed) used in the project b. the interest rate on the company's outstanding long-term bonds C. the type of security issued to finance the project d. the risk associated with the project 17. Which of the following can tell us which input variables we should focus on in further uncertainty analysis of a project? a. Forecasting simulation b. Monte Carlo simulation C. Sensitivity analysis d. Scenario analysis 18. Which of the following statements is false: a. If tax on dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts