Question

Slide #21: how much is v? Quoted price versus invoice price Today is 10/30/2030. A Treasury bond has a face value of $1000, maturity at

Slide #21: how much is v?

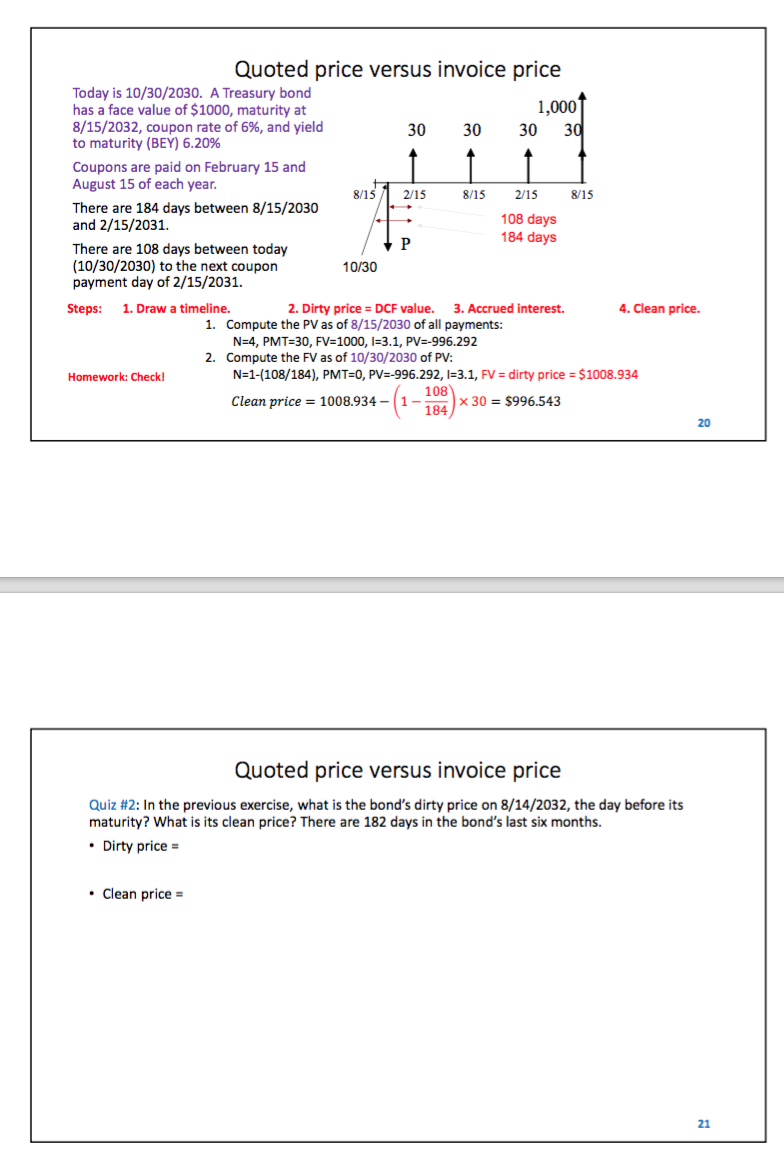

Quoted price versus invoice price Today is 10/30/2030. A Treasury bond has a face value of $1000, maturity at 8/15/2032, coupon rate of 6%, and yield to maturity (BEY) 6.20% Coupons are paid on February 15 and August 15 of each year. There are 184 days between 8/15/2030 and 2/15/2031. There are 108 days between today (10/30/2030) to the next coupon payment day of 2/15/2031. 1,000 30 30 30 30 8/15 2/15 8/15 2/15 8/15 108 days 184 days P 10/30 Steps: 1. Draw a timeline. Homework: Check! 2. Dirty price = DCF value. 3. Accrued interest. 4. Clean price. 1. Compute the PV as of 8/15/2030 of all payments: N=4, PMT=30, FV=1000, I=3.1, PV=-996.292 2. Compute the FV as of 10/30/2030 of PV: N=1-(108/184), PMT=0, PV=-996.292, I=3.1, FV = dirty price = $1008.934 108 Clean price = 1008.934- 1- x 30 = $996.543 184 Quoted price versus invoice price Quiz #2: In the previous exercise, what is the bond's dirty price on 8/14/2032, the day before its maturity? What is its clean price? There are 182 days in the bond's last six months. Dirty price = Clean price = 20 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION First lets draw a timeline of the bonds payments 8152030 Coupon payment date 10302030 Today...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started