Question: Slidell Co. (a U.S. firm) considers a foreign project in which it expects to receive 12 million euros at the end of this year.

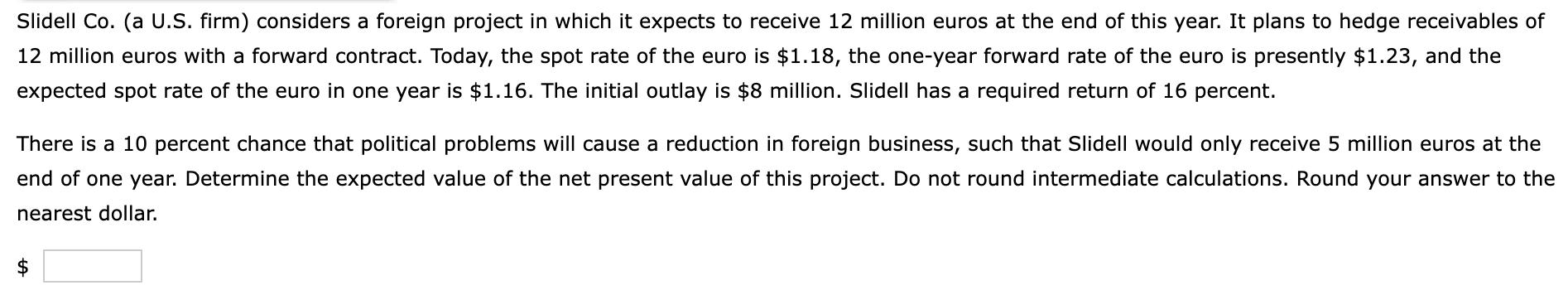

Slidell Co. (a U.S. firm) considers a foreign project in which it expects to receive 12 million euros at the end of this year. It plans to hedge receivables of 12 million euros with a forward contract. Today, the spot rate of the euro is $1.18, the one-year forward rate of the euro is presently $1.23, and the expected spot rate of the euro in one year is $1.16. The initial outlay is $8 million. Slidell has a required return of 16 percent. There is a 10 percent chance that political problems will cause a reduction in foreign business, such that Slidell would only receive 5 million euros at the end of one year. Determine the expected value of the net present value of this project. Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Heres how to calculate the expected value of the net present value NPV of the project Scenario 1 Nor... View full answer

Get step-by-step solutions from verified subject matter experts