Question: Slove as soon as possible. Asap! Only use equations/formulas, Do not use excell. Thank you so so much. Question 7 24 points Save Ans Copy

Slove as soon as possible. Asap! Only use equations/formulas, Do not use excell. Thank you so so much.

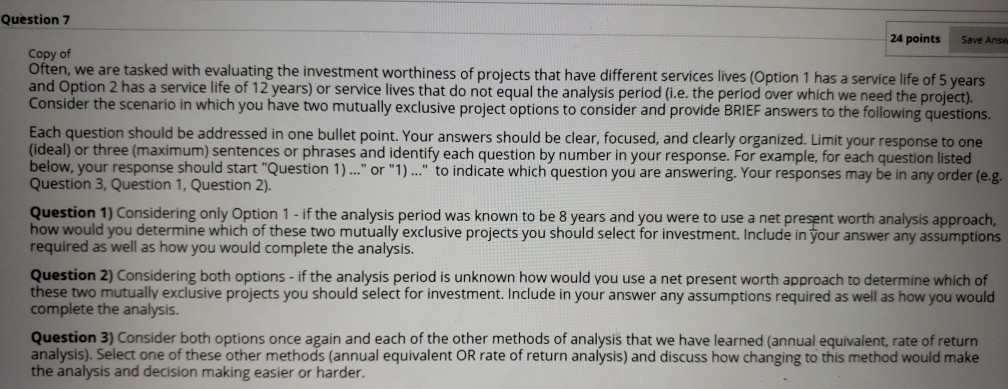

Question 7 24 points Save Ans Copy of Often, we are tasked with evaluating the investment worthiness of projects that have different services lives (Option 1 has a service life of 5 years and Option 2 has a service life of 12 years) or service lives that do not equal the analysis period (i.e. the period over which we need the project). Consider the scenario in which you have two mutually exclusive project options to consider and provide BRIEF answers to the following questions. Each question should be addressed in one bullet point. Your answers should be clear, focused, and clearly organized. Limit your response to one (ideal) or three (maximum) sentences or phrases and identify each question by number in your response. For example, for each question listed below, your response should start "Question 1)..." or "1)..." to indicate which question you are answering. Your responses may be in any order (e.g. Question 3, Question 1. Question 2). Question 1) Considering only Option 1 - if the analysis period was known to be 8 years and you were to use a net present worth analysis approach, how would you determine which of these two mutually exclusive projects you should select for investment. Include in your answer any assumptions required as well as how you would complete the analysis. Question 2) Considering both options - if the analysis period is unknown how would you use a net present worth approach to determine which of these two mutually exclusive projects you should select for investment. Include in your answer any assumptions required as well as how you would complete the analysis. Question 3) Consider both options once again and each of the other methods of analysis that we have learned (annual equivalent, rate of return analysis). Select one of these other methods (annual equivalent OR rate of return analysis) and discuss how changing to this method would make the analysis and decision making easier or harder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts