Question: Solve as soon as possible. Asap! Only use equations/formulas. Do not use excell. Thank you so much. Question Completion Status: Question 4 16 points Save

Solve as soon as possible. Asap! Only use equations/formulas. Do not use excell. Thank you so much.

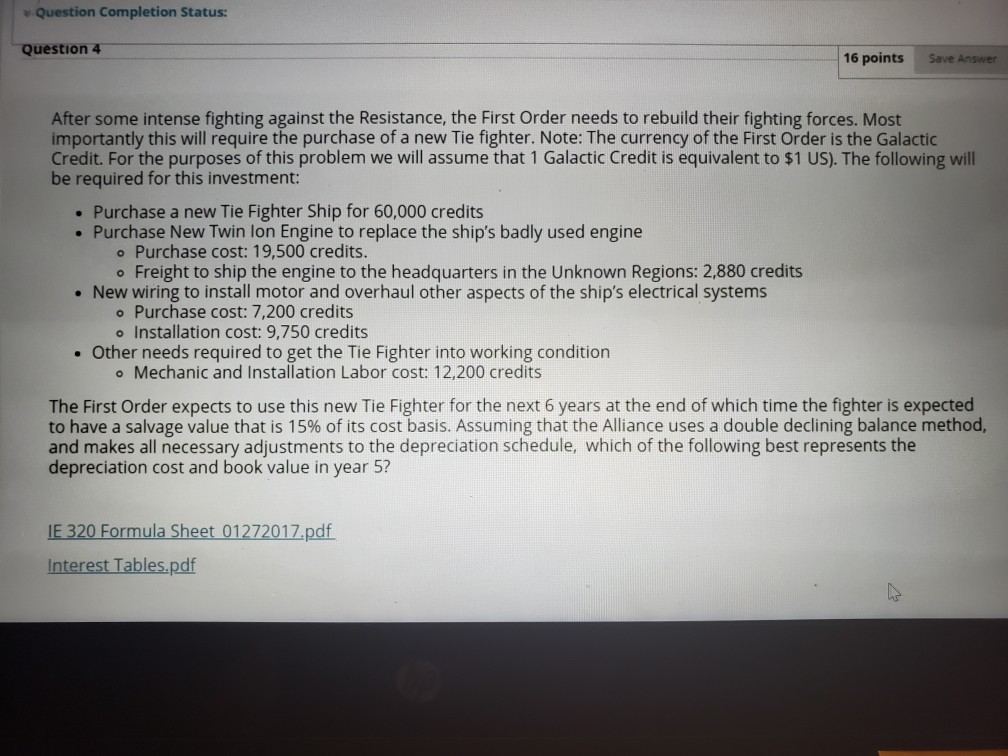

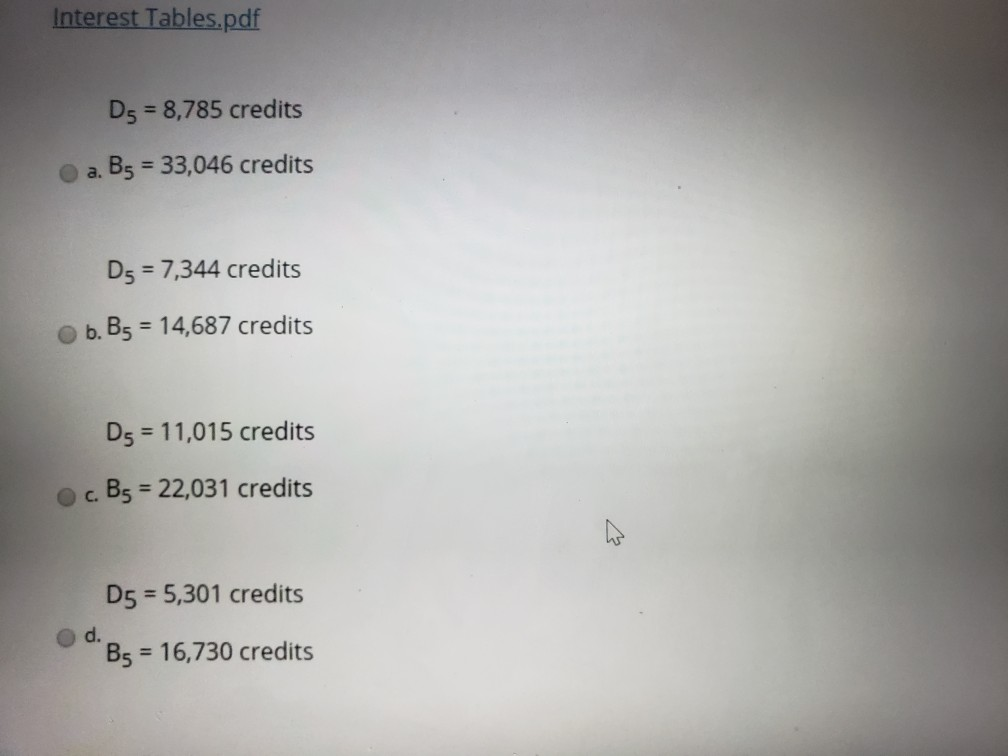

Question Completion Status: Question 4 16 points Save Answer After some intense fighting against the Resistance, the First Order needs to rebuild their fighting forces. Most importantly this will require the purchase of a new Tie fighter. Note: The currency of the First Order is the Galactic Credit. For the purposes of this problem we will assume that 1 Galactic Credit is equivalent to $1 US). The following will be required for this investment: Purchase a new Tie Fighter Ship for 60,000 credits Purchase New Twin lon Engine to replace the ship's badly used engine o Purchase cost: 19,500 credits. Freight to ship the engine to the headquarters in the Unknown Regions: 2,880 credits New wiring to install motor and overhaul other aspects of the ship's electrical systems . Purchase cost: 7,200 credits o Installation cost: 9,750 credits Other needs required to get the Tie Fighter into working condition . Mechanic and Installation Labor cost: 12,200 credits The First Order expects to use this new Tie Fighter for the next 6 years at the end of which time the fighter is expected to have a salvage value that is 15% of its cost basis. Assuming that the Alliance uses a double declining balance method, and makes all necessary adjustments to the depreciation schedule, which of the following best represents the depreciation cost and book value in year 5? IE 320 Formula Sheet 01272017.pdf Interest Tables.pdf Interest Tables.pdf D5 = 8,785 credits a. B5 = 33,046 credits D5 = 7,344 credits b. B5 = 14,687 credits Ds = 11,015 credits c. B5 = 22,031 credits D5 = 5,301 credits d. B5 = 16,730 credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts