Question: Smart Touch Learning began operations on December 1 by receiving $26,400 cash and furniture of a fair value of $9,100 from James Smith. The business

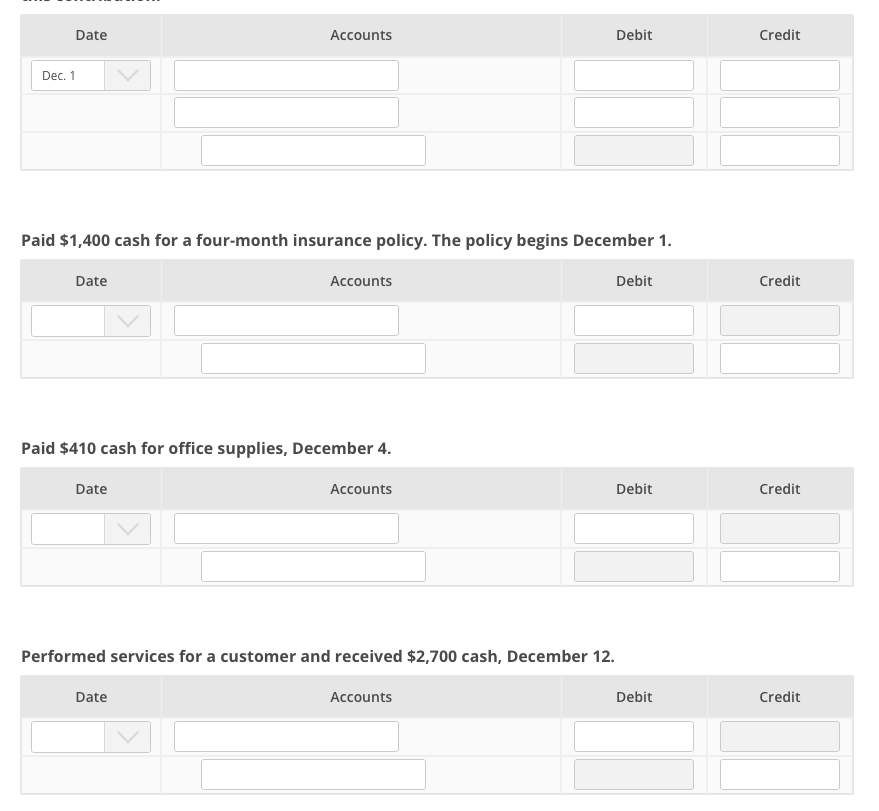

Smart Touch Learning began operations on December 1 by receiving $26,400 cash and furniture of a fair value of $9,100 from James Smith. The business issued Smith shares of common stock in exchange for this contribution.

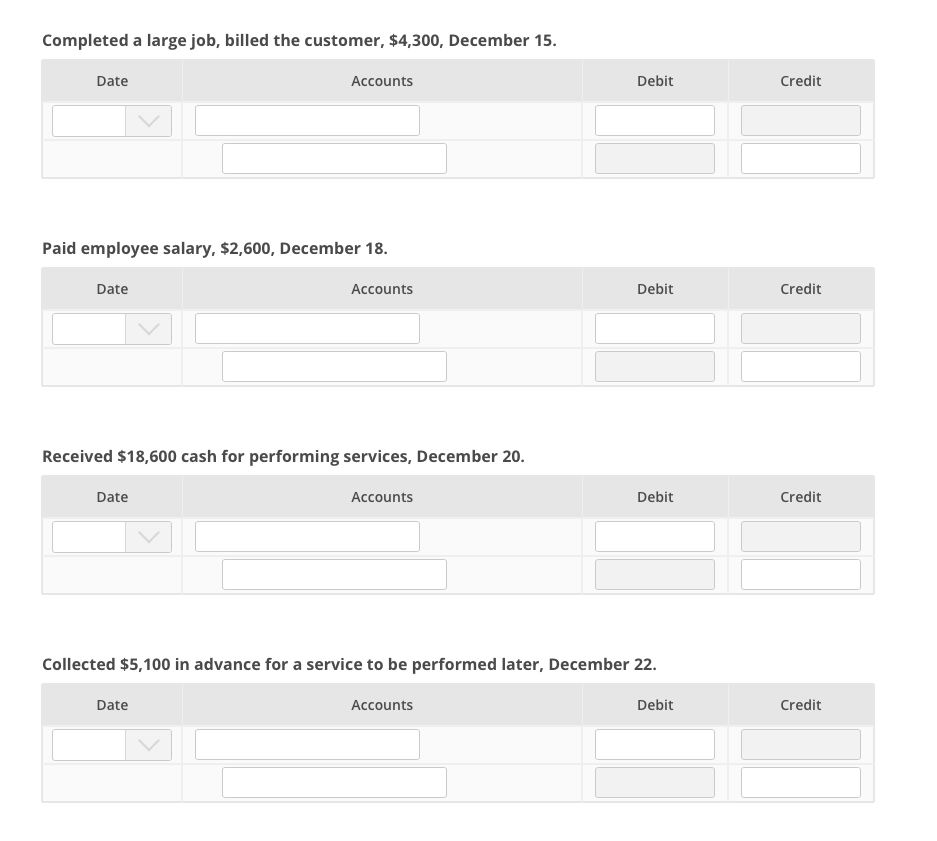

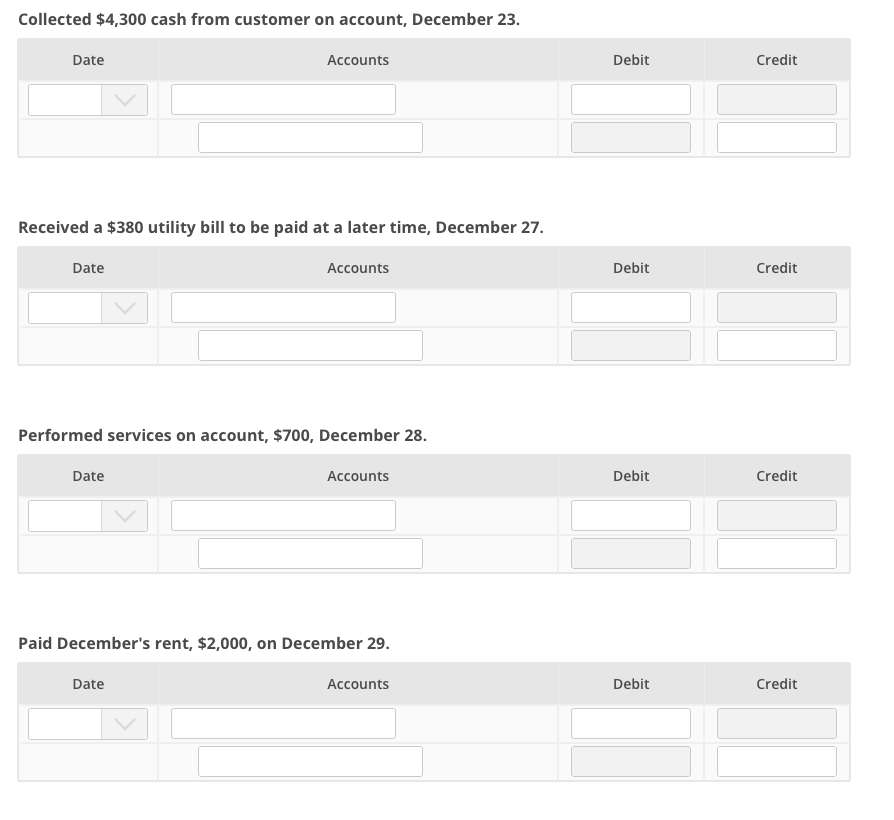

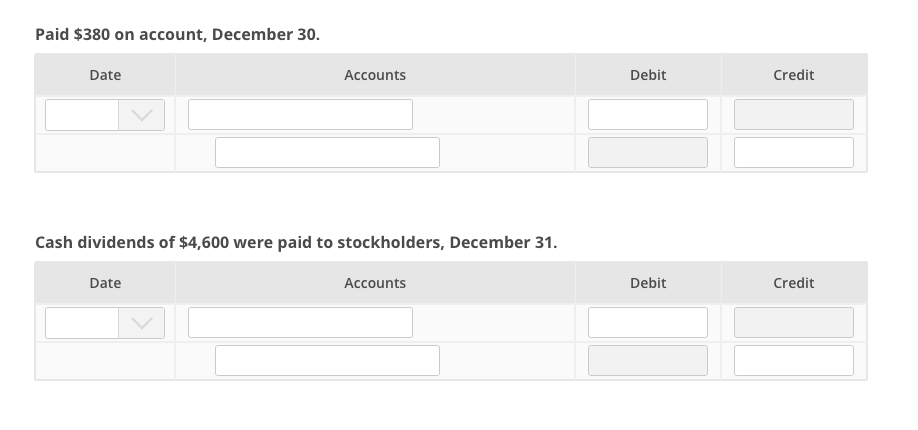

Date Accounts Debit Credit Dec.1 Paid $1,400 cash for a four-month insurance policy. The policy begins December 1 Date Accounts Debit Credit Paid $410 cash for office supplies, December 4. Date Accounts Debit Credit Performed services for a customer and received $2,700 cash, December 12. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts